Running a small business or working as a freelancer comes with many responsibilities, one of the most crucial being payroll. Whether you have a handful of employees or work for yourself, keeping track of your earnings, taxes, and deductions is essential for smooth financial operations. This is where a free paycheck creator can be a game-changer.

In this blog, we’ll explore how small businesses and freelancers can benefit from using a free paycheck creator, the importance of accurate pay stubs, and why this tool is becoming indispensable in today’s fast-paced work environment. We’ll cover the key features, advantages, and practical tips on how to make the most out of this simple yet powerful tool.

What is a Free Paycheck Creator?

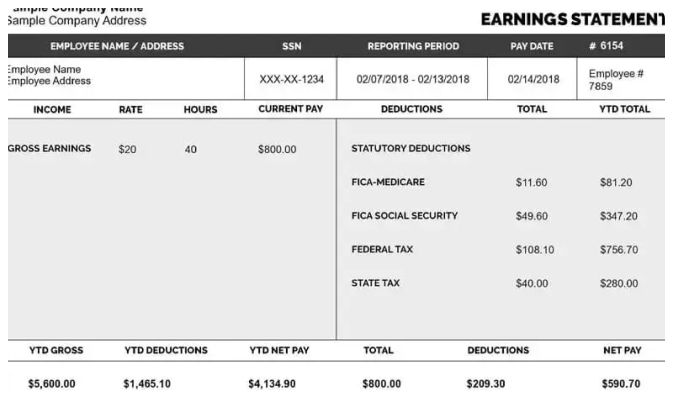

A free paycheck creator is an online tool or software that allows business owners and freelancers to generate professional pay stubs quickly and easily. Pay stubs are essential documents that show an employee’s earnings, deductions, and tax information for a given pay period. They are also a crucial record for freelancers to track their income and for small business owners to maintain payroll transparency.

Unlike traditional payroll software, which can be costly and complicated, a free paycheck creator offers an accessible and easy-to-use alternative. Most free paycheck creators allow you to customize the pay stubs according to your business needs and generate them instantly without any cost.

Why Small Businesses Need a Free Paycheck Creator

As a small business owner, you have to wear many hats – managing operations, marketing, customer service, and finance. Payroll is an essential aspect of running a business, but it doesn’t have to be a burden. A free paycheck creator makes payroll management simpler, more efficient, and cost-effective, especially for small businesses that may not have the resources for expensive payroll services.

1. Save Time and Effort

Payroll can be a time-consuming task, especially when you need to calculate wages, deductions, and taxes manually. A free paycheck creator automates much of the process, allowing you to input basic information such as employee hours, wages, and deductions and then generate a pay stub in just a few clicks. This means less time spent on paperwork and more time spent on growing your business.

2. Cost-Effective Solution

As a small business, managing expenses is key to your survival. Traditional payroll services often come with hefty monthly fees, sometimes costing hundreds of dollars. A free paycheck creator removes that financial burden. It gives you the same professional pay stub capabilities without the high price tag, making it a perfect choice for businesses just starting or looking to reduce unnecessary overhead costs.

3. Accuracy and Compliance

Accurate payroll is crucial for staying compliant with tax laws. Mistakes in calculating taxes, withholdings, and overtime can lead to penalties and legal trouble. A free paycheck creator helps ensure that your pay stubs are accurate and compliant with current tax rates and laws. Many tools automatically calculate federal and state tax deductions, Social Security, Medicare, and other necessary contributions based on the input data.

4. Employee Trust and Transparency

When you offer employees clear and detailed pay stubs, it builds trust. Employees feel more confident when they know exactly how their wages are calculated, what deductions are made, and how much they are earning. A free paycheck creator allows you to provide pay stubs that include all the necessary details—pay rate, hours worked, overtime, bonuses, tax deductions, and more—so employees always know where their money is coming from.

Why Freelancers Need a Free Paycheck Creator

Freelancers, independent contractors, and gig workers face a different set of challenges when it comes to payroll. Unlike traditional employees, freelancers often work with multiple clients, receive variable payments, and may need to track taxes differently. A free paycheck creator is an invaluable tool for freelancers who want to stay organized, keep track of their income, and maintain professionalism.

1. Track Earnings and Income for Taxes

As a freelancer, managing your income is crucial for tax season. You don’t have the luxury of automatic paycheck deductions like traditional employees, so it’s important to keep track of your earnings to estimate your taxes. A free paycheck creator can help you track your freelance income by creating a detailed record of each payment you receive. This makes it easier to calculate your self-employment taxes and avoid any surprises when filing your taxes.

2. Professionalism with Clients

When you send a professional pay stub to clients, it helps establish credibility and trust. Even though freelancers are not employees, providing pay stubs shows that you are serious about your work and that you follow industry standards. It also helps clients understand the breakdown of your rates, including taxes, expenses, and overtime, if applicable.

3. Easy Invoice Integration

Many free paycheck creators also integrate with invoicing systems. This means you can directly create pay stubs based on the invoices you’ve sent to clients. By syncing your invoices with your paycheck creator, you can ensure that your pay stubs reflect the exact payments you’ve received, including any adjustments or additional fees. This eliminates the need to track each payment manually and simplifies the financial management process.

4. Tracking Deductions and Benefits

Even as a freelancer, you may have deductions to consider, such as health insurance, retirement contributions, or business expenses. A free paycheck creator can help you track these deductions, ensuring that you have a clear record of all expenses associated with your freelance work. This is especially important when it comes to tax deductions and ensuring that you don’t overpay during tax season.

Key Features to Look for in a Free Paycheck Creator

Not all free paycheck creators are created equal. When choosing the best one for your business or freelance needs, here are some key features to consider:

1. Ease of Use

The tool should be intuitive and easy to navigate. You should be able to input your payroll information quickly and generate pay stubs with minimal effort. Avoid overly complicated platforms with unnecessary features that might confuse you.

2. Customization Options

You may want to customize your pay stubs to reflect your business’s unique needs. Look for a paycheck creator that allows you to add your business logo, choose different pay periods, and include specific deductions that apply to your business or freelance work.

3. Accuracy in Calculations

A reliable free paycheck creator should automatically calculate taxes, deductions, and benefits. Make sure the tool is up to date with the latest tax rates and compliant with local and federal regulations. This will save you from making costly mistakes.

4. Exporting Options

Once you’ve created your pay stubs, you’ll want to save or share them easily. Look for a paycheck creator that allows you to export your pay stubs as PDFs, which are easy to store and share with employees or clients.

5. Security and Privacy

Since you’ll be inputting sensitive financial information, ensure that the paycheck creator has strong data security features to protect your business and employee information.

Conclusion: Why a Free Paycheck Creator is a Must-Have Tool for Small Businesses and Freelancers

Whether you’re a small business owner trying to streamline payroll operations or a freelancer managing multiple clients and income sources, a free paycheck creator is an essential tool to have in your arsenal. It saves you time, money, and effort while ensuring that you remain accurate and compliant with tax laws.

By using a free paycheck creator, you can focus more on growing your business or delivering quality freelance work, while knowing that your payroll management is in good hands. With its ease of use, accuracy, and cost-effectiveness, this tool provides significant benefits for both small businesses and freelancers alike.

If you’re not already using a paycheck creator, now is the time to start! The right tool will not only simplify your payroll process but also help you maintain professionalism and stay organized throughout the year.

Related Articles

How to Access Kroger Paystubs Anytime, Anywhere

Complete Guide to Dollar General Paystubs(DG Paystub) and DGME Portal

How to Use the Walmart Paystub Portal Easily?

Employee Guide: Accessing ADP Pay Stubs with Ease

How To Get a Pay Stub From Ford?

How to Access, Download, and Interpret Dollar Tree Pay Stubs

Why is Intuit Paystub Perfect for Payroll Management? 5 Key Reasons