Mild Steel (MS) beams are essential structural components used extensively in construction, manufacturing, and infrastructure projects. Understanding the price trends of MS beams is crucial for builders, manufacturers, traders, and stakeholders in these sectors. This article provides a comprehensive analysis of MS (Mild Steel) Beam Price Forecast, covering historical data, recent fluctuations, market dynamics, and future outlook.

Historical Price Trends

Early 2000s to 2010

From the early 2000s to 2010, the price of MS beams exhibited moderate fluctuations. Key factors influencing prices during this period included:

- Raw Material Costs: The primary raw material for MS beam production is steel, and fluctuations in steel prices directly impacted MS beam prices.

- Industrial Demand: Growing demand from the construction and manufacturing industries drove price trends.

- Economic Conditions: Global economic conditions, including inflation rates, currency fluctuations, and trade policies, influenced MS beam prices.

Request a free sample copy in PDF: https://www.expertmarketresearch.com/price-forecast/mild-steel-beam-price-forecast/requestsample

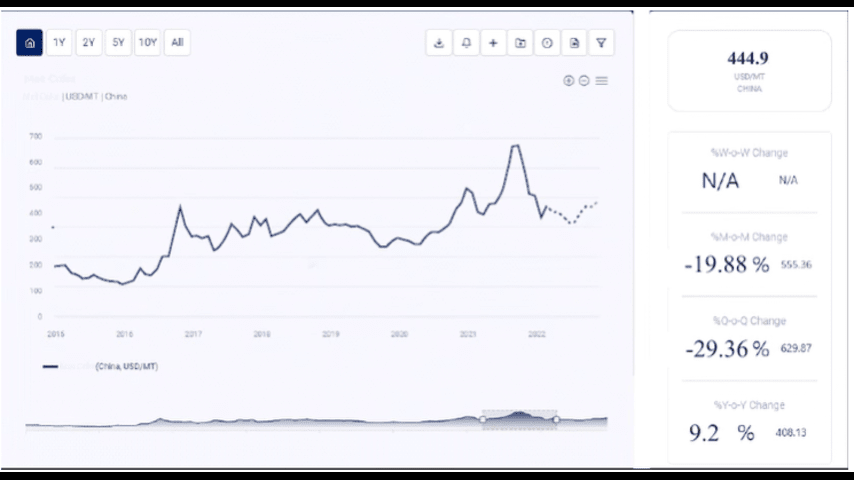

2010 to 2020

Between 2010 and 2020, MS beam prices showed considerable volatility, generally stabilizing. Key factors during this period included:

- Increased Demand: Expanding applications in various industries, particularly in construction and infrastructure development, increased demand for MS beams.

- Technological Advancements: Improvements in production technologies and efficiencies helped stabilize prices.

- Regulatory Policies: Environmental and safety regulations promoting safer and more efficient production processes positively impacted demand and pricing.

Read Full Report With Table Of Contents — https://www.expertmarketresearch.com/price-forecast/mild-steel-beam-price-forecast

Recent Price Trends (2020–2023)

Impact of COVID-19

The COVID-19 pandemic had a significant impact on global markets, including MS beams. In early 2020, prices fell due to reduced industrial activity and disruptions in supply chains. However, as demand for construction materials surged due to increased infrastructure projects and economic recovery efforts, MS beam prices rebounded.

2021 to 2023

From 2021 onwards, MS beam prices experienced significant fluctuations, influenced by the following factors:

- Raw Material Shortages: Supply chain disruptions and raw material shortages, particularly of steel, led to price increases.

- Rising Production Costs: Increased costs of energy, transportation, and labor contributed to higher production costs, which were reflected in market prices.

- Environmental Regulations: Stricter environmental regulations in key markets, such as the European Union, drove demand for sustainably produced steel products.

- Economic Recovery: As economies recovered from the pandemic, increased industrial activity and consumer spending boosted demand for MS beams.

Market Dynamics

Supply Factors

The supply of MS beams is influenced by several key factors:

- Raw Material Availability: The availability and cost of raw materials like steel significantly impact production costs and supply levels.

- Production Capacity: The capacity of manufacturing facilities to produce MS beams affects supply. Investments in new plants or expansions of existing ones can increase supply.

- Geopolitical Stability: Political stability in regions producing key raw materials and MS beams themselves can affect supply chains and prices.

Demand Factors

Demand for MS beams is driven by their applications in various sectors:

- Construction: MS beams are widely used in the construction industry for structural support, framing, and reinforcement in buildings, bridges, and other infrastructure projects.

- Manufacturing: They are used in the manufacturing of machinery, equipment, and transportation vehicles.

- Infrastructure Development: MS beams are essential in infrastructure projects such as bridges, roads, railways, and large-scale public works.

Technological Advancements

Technological advancements play a crucial role in shaping the MS beam market:

- Production Efficiency: Innovations in production technologies can improve efficiency, reduce waste, and lower production costs.

- Sustainable Practices: Development of sustainable production practices, such as using renewable energy sources and improving process efficiencies, can enhance the environmental footprint of MS beam production.

Environmental and Regulatory Impact

Environmental and regulatory factors significantly influence the MS beam market:

- Sustainability Initiatives: Increasing focus on sustainability and environmental protection has led to greater demand for eco-friendly steel products like MS beams.

- Regulatory Compliance: Compliance with environmental regulations and standards, such as those set by the EPA in the United States and REACH in the European Union, impacts production practices and costs.

- Carbon Footprint: Efforts to reduce the carbon footprint of steel production, including the use of renewable energy and carbon capture technologies, are becoming increasingly important.

Future Outlook

The future outlook for MS beam prices is influenced by several factors:

- Technological Innovations: Continued advancements in production technologies and new applications will drive market growth and impact pricing.

- Global Economic Conditions: Economic recovery and growth, especially in developing markets, will drive demand for MS beams in various industrial applications.

- Environmental Regulations: Stricter environmental regulations and sustainability initiatives will promote the use of eco-friendly MS beams.

- Raw Material Supply: Ensuring a stable supply of key raw materials like steel will be crucial for maintaining stable production costs and pricing.

Related Report

https://www.expertmarketresearch.com/price-forecast/polycarbonate-price-forecast

https://www.expertmarketresearch.com/price-forecast/ms-plate-price-forecast

Media Contact:

Company Name: Claight Corporation

Contact Person: Leo Frank, Business Consultant

Email: sales@expertmarketresearch.com

Toll Free Number: US +1-415-325-5166 | UK +44-702-402-5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: www.expertmarketresearch.com