How SharkShop Credit Solutions Work to Improve Your Score

Are you tired of feeling like your credit score is holding you back from financial freedom? You’re not alone! Many individuals face the daunting challenge of navigating the complexities of credit scores, which can often feel like an uphill battle. But what if we told you there’s a solution designed to simplify this journey and empower you along the way?

Enter SharkShop.biz Credit Solutions! In this blog post, we’ll dive into how SharkShop can help transform your credit profile, boost your score, and ultimately pave the way for better financial opportunities. Whether you’re looking to secure that dream home or simply want to enjoy lower interest rates on loans, understanding how these innovative solutions work is the first step toward achieving your goals. Let’s unlock the secrets together—your brighter financial future awaits!

Introduction to SharkShop Credit Solutions

In today’s financial landscape, having a good credit score is more important than ever. It affects everything from loan approvals to interest rates on your mortgage. If you find yourself struggling with a less-than-stellar score, SharkShop.biz Credit Solutions might be the lifeline you need.

With their innovative approach and personalized strategies, they aim to help individuals reclaim control over their financial future. But how exactly do they operate? Let’s dive into the world of credit scores and explore how SharkShop can make a positive impact on yours.

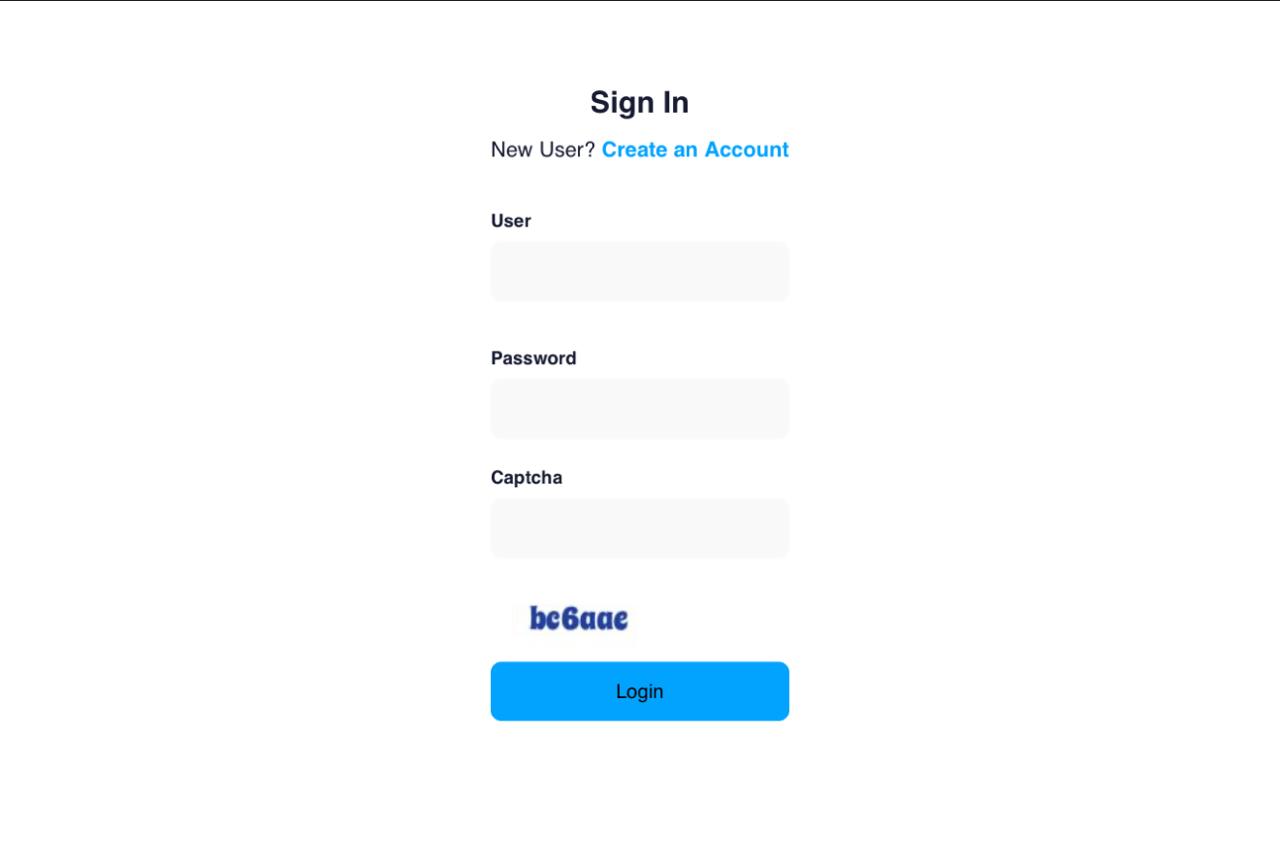

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding How Credit Scores Work

Credit scores are numerical representations of your creditworthiness. They typically range from 300 to 850, with higher scores indicating better credit health. Several factors influence these numbers.

Payment history is a major component. Late payments can significantly drop your score. Lenders want assurance that you’ll repay borrowed funds on time.

Credit utilization also plays a crucial role. This ratio compares your total debt to available credit limits. Keeping this percentage low shows responsible borrowing habits.

Length of credit history matters too. Longer accounts reflect stability and reliability, which lenders appreciate.

New credit inquiries can impact your score as well, especially if you’re applying for multiple loans simultaneously. Each inquiry signals risk to potential lenders.

Lastly, the mix of different types of credit—like installment loans and revolving accounts—can enhance your profile when managed responsibly.

How SharkShop Helps Improve Your Credit Score

SharkShop takes a tailored approach to enhancing your credit score. They start by crafting a personalized Credit Improvement Plan that suits your specific financial situation. This plan outlines actionable steps designed to boost your score over time.

Next, their team conducts a professional credit analysis and ongoing monitoring. You receive insights into what affects your score, allowing you to make informed decisions about managing debt and payments.

The strategic dispute process is another key feature. SharkShop identifies inaccuracies in your credit report and works diligently to challenge them. By addressing these errors, they help clear the path for an improved credit profile.

This comprehensive support empowers clients, making it easier for them to reach their financial goals without the stress of navigating the complexities of credit repair alone.

– Personalized Credit Improvement Plan

Every individual has a unique financial story. SharkShop recognizes this and tailors its approach to credit improvement. With a personalized credit improvement plan, clients receive strategies specifically designed for their situation.

This starts with an in-depth assessment of your current credit status. By understanding your strengths and weaknesses, SharkShop crafts actionable steps that resonate with your goals. Whether it’s addressing outstanding debts or optimizing existing accounts, the focus is on you.

Regular check-ins ensure that you stay on track. Adjustments are made as necessary to account for any changes in circumstances or objectives. This collaborative method not only helps improve scores but also empowers clients with knowledge about managing their finances effectively.

Ultimately, it’s about creating a roadmap that leads to lasting financial health and confidence in credit management.

– Professional Credit Analysis and Monitoring

SharkShop offers thorough professional credit analysis designed to pinpoint areas for improvement. Their team of experts dives deep into your credit report, identifying negative marks and patterns that might be dragging down your score.

With this comprehensive evaluation, they create actionable insights tailored to your unique financial situation. You won’t just receive generic advice; instead, you’ll benefit from a personalized approach that addresses specific issues impacting your credit health.

Monitoring is another crucial aspect of SharkShop’s services. Continuous tracking ensures you’re always aware of changes in your credit status. This proactive strategy allows for timely adjustments and interventions when necessary, keeping you on the path toward better creditworthiness.

By leveraging both analysis and monitoring together, SharkShop login empowers clients with knowledge and tools essential for making informed decisions about their financial future. It’s more than just repair—it’s about building a stronger foundation for lasting success.

– Strategic Dispute Process

Navigating the world of credit can be complex, especially when inaccuracies arise. SharkShop employs a strategic dispute process to tackle these issues head-on.

When you identify a potential error on your credit report, timely action is crucial. SharkShop’s team knows how to approach disputes in an efficient manner. They gather all necessary documentation and evidence to support your case.

Communication with credit bureaus is key during this process. The experts at SharkShop ensure that each dispute is crafted carefully for maximum impact. They don’t just send generic letters; they personalize each communication based on individual circumstances.

This meticulous attention to detail increases the likelihood of successful outcomes. It’s about more than just fixing errors—it’s about restoring trust in your financial history and boosting your overall score effectively.

Success Stories from SharkShop Customers

At SharkShop, real-life transformations speak volumes. Take Sarah, for instance. After struggling with a low credit score due to medical bills, she turned to SharkShop. Within months, her score improved significantly. She was finally able to secure a mortgage for her dream home.

Then there’s James, who faced challenges after identity theft left his credit in shambles. With the help of SharkShop’s expert team and their strategic dispute process, he regained control over his financial reputation. Today, he enjoys better loan rates and has plans for starting a new business.

These are just glimpses into how SharkShop changes lives by empowering customers through personalized solutions tailored to individual needs. Each success story demonstrates the potential that lies within effective credit management strategies offered by this innovative service provider.

Common Myths about Credit Repair Services

Many people hold misconceptions about credit repair services. One common myth is that they can instantly erase negative information from your report. The truth is, legitimate services work within the framework of the law and cannot guarantee quick fixes.

Another widespread belief is that all credit repair companies are scams. While some may be less than honest, many reputable firms provide valuable assistance in navigating complex credit issues.

Some individuals think they can handle everything on their own, believing that professional help isn’t necessary. However, experts often spot errors or discrepancies that you might overlook.

Finally, there’s an assumption that using a credit repair service will hurt your score further. In reality, these professionals aim to enhance your score through strategic actions—supporting your financial health rather than hindering it.

Alternatives to SharkShop Credit Solutions

While SharkShop cc offers effective credit improvement strategies, there are other options available for those looking to boost their credit scores.

Credit counseling services can provide personalized advice and budgeting help. These programs often focus on debt management while offering educational resources about maintaining a healthy credit profile.

Another alternative is DIY credit repair. This involves researching your rights under the Fair Credit Reporting Act and disputing inaccuracies directly with creditors or bureaus. It requires diligence but can be rewarding if you have the time to invest.

Peer support groups also exist, where individuals share tips based on personal experiences. Joining such communities can motivate you and provide valuable insights into improving your finances without professional intervention.

Lastly, some might consider traditional financial institutions that offer specific loan products aimed at rebuilding credit history. Each of these alternatives has its unique benefits and challenges worth exploring before making a decision.

Conclusion: Is SharkShop Right for You?

Choosing the right credit solutions provider can be crucial for your financial health. SharkShop.biz offers a range of services designed to help you improve your credit score effectively. Their personalized approach ensures that each client receives tailored assistance based on their unique situation.

If you’re looking for professional guidance, SharkShop’s expert team could be a valuable resource. They not only analyze and monitor your credit but also assist in disputing inaccuracies. With success stories backing their methods, many customers have seen significant improvements.

However, it’s essential to consider whether these services align with your needs and goals. Researching alternatives or seeking advice from friends or family can provide additional insights into what may work best for you.

Ultimately, assessing how well SharkShop fits into your overall strategy will guide you toward making an informed decision about improving your credit standing.