After assessing the goods, XYZ Co. returned products worth $50,000 as they suffered damages during the delivery. ABC Co. compensated XYZ Co. for the returns by reducing its accounts receivable balance. Instead of debiting the sales returns account, companies will debit the sales allowances how to do a journal entry for purchases on a notes payable chron com account. Like other contra accounts, the contra revenue account goes against revenues in the income statement. Sales returns, allowances and discounts are some of the examples of this type of contra account. Some companies may keep these accounts together due to their similar nature.

Return of Merchandise Sold on Account

- A sales allowance occurs when a customer chooses to accept such goods but at a reduced price.

- On the same date, merchandise amounting to $200 were returned to John Enterprise because they failed to meet the required quality standards.

- Any difference between invoice price and reduced price (i.e., the price that is finally received from the customer) is known as allowance.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

A sales allowance is a reduction in the price of goods charged by a company. Instead, companies offer a sales allowance after when it makes sales. Trade discounts usually involve a reduction in price before the sale occurs. Similarly, a sales allowance does not entail a discount for an early payment, which is what cash discounts are. During this process, the goods may go under physical changes or deformities. Once customers receive the products, they may not work as intended or suffered damages.

What type of journal entry is required when return goods are given by the customer?

These examples illustrate how sales transactions, whether in cash or on credit, are recorded in the company’s journal. Such entries are crucial for accurate financial reporting and analysis, providing insights into the company’s operational performance and financial health. Sales or revenues is a credit account due to its nature of being an income or increase in equity.

Sales Revenue Journal Entry

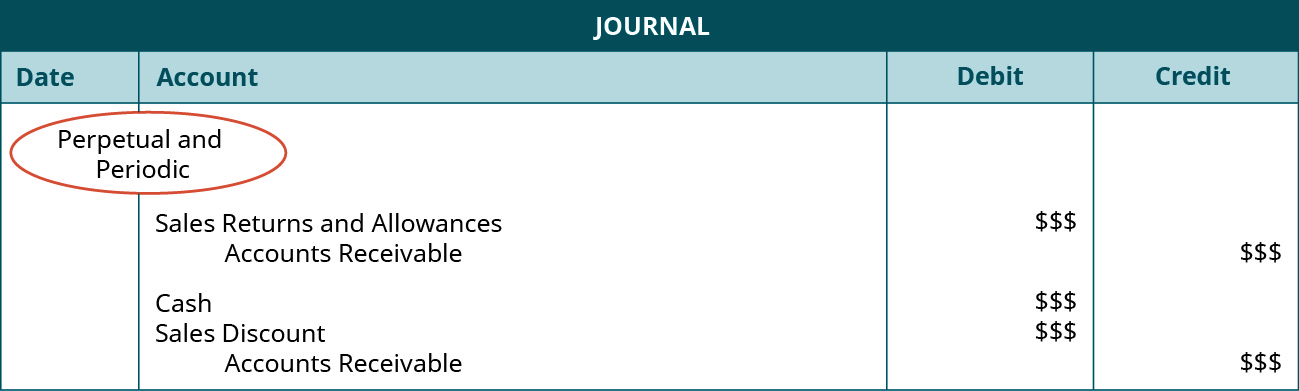

Some companies may not have sales returns and allowances account for some reasons, e.g. they do not have many transactions, so it is not worth keeping track. In this case, the company usually directly debit sales revenue and credit accounts receivable to reverse the original sale transactions when there are sales returns. In this case, the “sales returns and allowances” account is required for recording such transactions. Sales returns and allowances account is the contra account to sale revenues.

All income statement accounts with debit balances are credited to bring them to zero. The Income Summary account is closed to the Retained Earnings account. The effect is to transfer temporary (income statement) account balances in the income summary totalling $4,034 to the permanent (balance sheet) account, Retained Earnings.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

For locations with sales taxes, you also need to record the sales tax that your customer paid so you know how much to pay the government later. Let’s look at an example where the customer paid cash and then changed their mind a few days later. They returned the item to you and received a full refund from you, including taxes. You also have to make a record of your inventory moving and the sales tax. When you credit the revenue account, it means that your total revenue has increased.

Maria Trading Company always sells goods to its customers on account. The company collects sales tax at 7% on all goods sold by it and periodically sends the collected amount of tax to a tax-collecting agency. Sales returns occur when a customer does not accept goods and returns them to the seller for a full refund or credit. A sales allowance occurs when a customer chooses to accept such goods but at a reduced price. On 2nd Feb 2020, the firm recorded credit sales of 10 pieces for product Y and 15 pieces for product Z to one of its old customers for $50 and $25 each respectively.