In the world of business and personal finance, one of the most important documents you will encounter is a check stub. Whether you’re a freelancer, a small business owner, or an employee, a professional and clear check stub is essential for keeping track of earnings, taxes, and other deductions. Customizing your check stubs is not only about making them look polished but also ensuring they contain the right information in an easily understandable format.

If you’re looking to create and customize check stubs for maximum professionalism, this guide will walk you through all the necessary steps and provide you with tips and tools you can use. In this post, we’ll discuss how a check stub maker can help you design the best check stubs, why customization matters, and what elements to include.

What is a Check Stub?

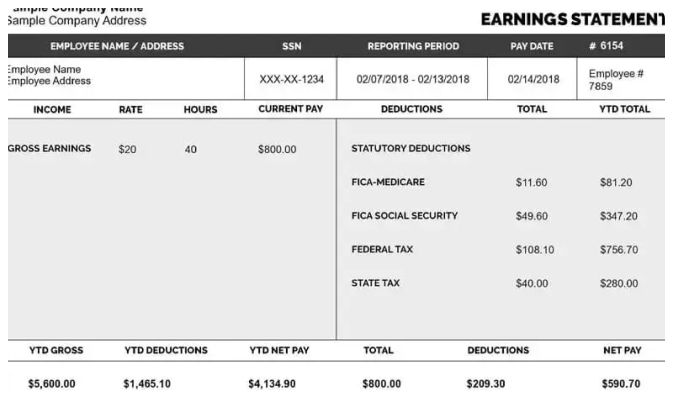

Before diving into customization, let’s define what a check stub is. A check stub (also called a pay stub) is a document that accompanies a paycheck and provides details about the earnings and deductions of the employee. It shows how much a person has earned over a particular pay period, including the net pay (the take-home amount) after taxes and other deductions.

For small business owners or freelancers, a check stub is just as crucial. It helps to keep records for tax purposes, ensures transparency with clients, and maintains professionalism in financial transactions.

Why Customizing Your Check Stubs Matters

Customizing your check stubs helps you professionally present yourself or your business. Here’s why customization is crucial:

- Professionalism: A well-organized and detailed check stub reflects a high level of professionalism. It shows that you care about providing accurate financial documentation to your employees or clients.

- Clarity: Customized check stubs can present information in a clearer, more organized format. This helps to reduce misunderstandings regarding salaries, deductions, and benefits.

- Brand Identity: For business owners, check stubs provide an opportunity to incorporate branding. Adding logos, company names, and specific color schemes can help reinforce your brand’s identity.

- Tax Compliance: Properly formatted and customized check stubs are essential for tax purposes. Including accurate information on your check stubs makes it easier to calculate taxes and ensure that all deductions are accounted for.

- Customization for Different Needs: Different businesses have different needs. For example, freelancers may need to show specific payment details, whereas large corporations may have multiple types of deductions. Customizing your check stubs allows you to include or exclude certain information depending on your specific requirements.

Key Features to Include in Your Custom Check Stub

To create a professional check stub, there are several important elements you need to include. These features will make your check stub not only functional but also professional and easy to read.

1. Your Business or Personal Details

For business owners, it’s important to include your business name, address, and contact information. If you’re a freelancer or self-employed, your name, address, and contact details should be listed clearly.

- Business Name/Your Name: Make sure your company or personal name is displayed at the top.

- Business Address/Your Address: Include your business address or your address (if applicable).

- Phone Number & Email Address: Include your contact number and email address for easy communication.

- Logo: If you’re a business owner, adding your company logo will add to the professionalism of your check stub.

2. Employee or Client Information

If you’re generating check stubs for employees, make sure to include their name, address, and contact details. For freelancers or small businesses working with clients, including client details is necessary for clarity.

- Employee Name: Clearly state the name of the person receiving payment.

- Employee Address: Include the employee’s address (if required).

- Client Information: For freelancers, it may be useful to add the client’s name or company name and contact details.

3. Pay Period and Payment Date

To ensure clarity, always specify the period for which the payment is made. This helps in tracking when the payment was earned, especially for hourly workers or freelancers.

- Start and End Date of Pay Period: Clearly state the time frame for which the payment covers (for example, “November 1, 2024 – November 15, 2024”).

- Payment Date: Include the date the payment was issued.

4. Earnings

The check stub should break down how much the person earned during the pay period. Whether it’s hourly, salary, or project-based, the earnings section should be clearly detailed.

- Regular Pay: List the regular pay earned, typically based on the hourly rate or salary.

- Overtime Pay: If applicable, include any overtime pay or additional pay for special work conditions.

- Bonuses/Commissions: If any bonuses or commissions were earned, be sure to include them.

- Other Earnings: This section can also cover additional payments like allowances, tips, or reimbursements.

5. Deductions

Deductions are an essential part of a check stub, as they show what was taken out of the employee’s pay. Common deductions include federal taxes, state taxes, retirement contributions, and health insurance premiums. Make sure to list each deduction separately and show the total.

- Federal and State Taxes: These include income taxes and other taxes mandated by the government.

- Social Security and Medicare: Deducted from each paycheck for federal benefits.

- Retirement Contributions (401(k), IRA): If the employee has opted for retirement savings, list those contributions.

- Health Insurance: If the employee contributes to a health insurance plan, show the deduction.

- Other Deductions: Include any other deductions, such as union fees or charitable contributions.

6. Net Pay

The net pay is the amount the employee or contractor takes home after all deductions. This should be displayed clearly at the bottom of the check stub.

- Gross Pay: The total earnings before any deductions.

- Total Deductions: A breakdown of all the deductions taken from the gross pay.

- Net Pay: The take-home amount after all deductions.

7. Employer Contributions

If you are an employer, it may be important to show employer contributions to benefits such as insurance, retirement plans, or taxes. These contributions are usually listed separately from employee deductions but are just as essential.

8. Custom Notes and Additional Information

A customized check stub can also include additional notes. This can include information such as:

- Payment Method: Whether the payment was made via direct deposit, check, or other methods.

- Notes Section: A space for any specific comments, such as special instructions, thanks for work well done, or upcoming holidays.

- Company Policies: A brief note about any changes in company policies, if applicable.

Using a Check Stubs Maker

Creating professional check stubs doesn’t have to be complicated. If you’re a business owner or freelancer, using a check stubs maker can make the process much easier. These online tools allow you to quickly generate customized check stubs that include all the necessary details. Many check stub makers even allow you to upload your company logo, add personalized notes, and adjust the layout to match your preferences.

Here are some benefits of using a check stub maker:

- Easy-to-Use Interface: Check stub makers typically have user-friendly interfaces, allowing you to input information quickly and accurately.

- Customization Options: Many check stub makers offer customization features, letting you choose what information to include and how it’s displayed.

- Accuracy: Automated check stub generators ensure that all the calculations (like taxes and deductions) are correct, reducing the risk of human error.

- Instant Access: You can create, download, and print your check stubs immediately, saving time and hassle.

How to Customize Your Check Stubs with a Check Stub Maker

- Choose a Template: Most check stub makers offer various templates. Select one that best fits your needs (e.g., salaried employees, freelancers, contractors).

- Enter Your Information: Input all the relevant details, including your company name, employee or client information, pay period, earnings, deductions, etc.

- Add Branding (if applicable): Upload your logo and adjust the color scheme to align with your brand.

- Review the Check Stub: Once all information is added, review the check stub to ensure everything is accurate.

- Download and Print: After reviewing, download the check stub and print it out, or send it electronically to your employees or clients.

Conclusion

Customizing your free check stubs is essential for maintaining professionalism and clarity. Whether you’re a business owner, freelancer, or an employee, a well-designed check stub offers transparency, helps with financial tracking, and ensures tax compliance. Using a check stub maker allows you to create professional, customizable check stubs quickly and easily. By including all the necessary details—like earnings, deductions, and net pay—you can make sure that your check stubs are informative and clear.

By following these tips and using the right tools, you’ll be able to produce top-notch check stubs that reflect your professionalism and attention to detail.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?