Freelancing has become an increasingly popular way for people to earn a living. Whether you’re a graphic designer, writer, photographer, or consultant, freelancing allows you to work on your terms. However, one of the most significant challenges that freelancers face is managing their finances. Unlike traditional employees who receive paychecks with clear deductions and tax information, freelancers have to keep track of their payments, taxes, and business expenses.

This is where a check stub maker can be incredibly helpful. A check stub maker is an online tool that allows you to generate pay stubs for your freelance work. It’s a simple way to document your earnings, track income and deductions, and protect your financial future. In this blog post, we’ll explain how freelancers can use a check stub maker to protect their earnings, stay organized, and ensure accurate financial records. We’ll walk you through the process step by step and explain why using a check stub maker is essential for freelancers.

What is a Check Stub Maker?

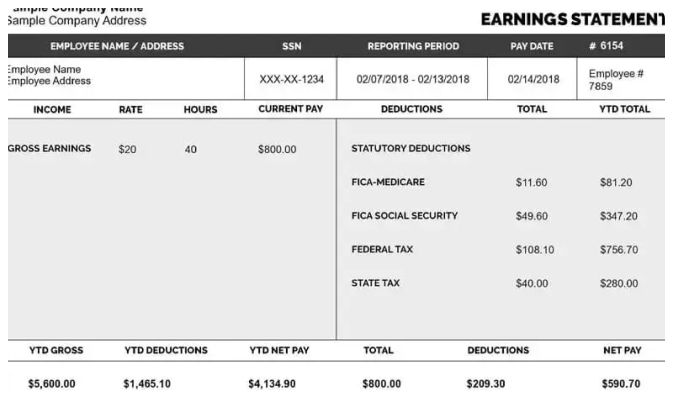

A check stub maker is an online tool that enables freelancers and business owners to create check stubs (or pay stubs). A check stub is a document that outlines the details of a payment, including the total amount earned (gross earnings), deductions (such as taxes or retirement contributions), and the final take-home pay (net pay).

For freelancers, the check stub serves as a record of each payment received, whether it’s from a client or an employer. Even though freelancers don’t receive traditional paychecks, they can use a check stub maker to generate detailed statements of their income. This is especially useful for tracking payments from multiple clients and ensuring that you’re keeping accurate financial records.

Why Should Freelancers Use a Check Stub Maker?

Freelancers face unique financial challenges, and managing income properly is one of the most important aspects of ensuring financial stability. Here’s why using a check stub maker is crucial for freelancers:

1. Keeps Track of Earnings

As a freelancer, you may work with several clients at once, and payments may come in at different times and amounts. Unlike a traditional employee who gets paid on a set schedule, your freelance income can vary each month. Without a formal structure for tracking your payments, it’s easy to lose track of how much you’ve earned from each client or project.

A check stub maker allows you to create a clear and organized record of your earnings for every job you complete. Whether you’re paid by the hour or a flat rate for a project, a check stub will break down the payment details for you. You can organize your check stubs by client or project, making it easier to manage multiple sources of income.

2. Helps with Tax Filing

One of the biggest challenges freelancers face is handling their taxes. Unlike traditional employees who have their taxes automatically deducted from their paychecks, freelancers are responsible for managing their taxes. This includes self-employment taxes, income taxes, and estimated quarterly tax payments.

By using a check stub maker, you can keep an accurate record of all your income throughout the year. When it comes time to file your taxes, you’ll have a detailed history of your earnings, deductions, and taxes paid, which makes the process easier and more accurate. You won’t have to scramble for receipts or worry about forgetting income sources. A check stub provides a clear record, which makes tax filing much more efficient.

3. Provides Proof of Income

If you’re applying for a loan, renting an apartment, or even setting up credit, you may need to provide proof of income. For freelancers, this can be tricky since you don’t receive regular paychecks. Having a check stub maker allows you to generate professional pay stubs that serve as proof of income whenever you need it.

These check stubs act as formal documentation of the work you’ve done and the amount you’ve earned, which is often required by banks, landlords, and even clients. The clear breakdown of gross income, deductions, and net pay will make it easy for others to verify your income.

4. Keeps You Protected in Case of Disputes

Payment disputes are not uncommon in freelancing. A client may dispute the amount they owe, or there might be confusion over the terms of payment. In such situations, it’s important to have clear documentation to back up your claims.

Using a check stub maker ensures that you have a detailed record of your earnings, including all agreed-upon rates and payment schedules. If a client tries to dispute the payment or delay it, you can refer to the check stub as evidence of the payment terms. This documentation will protect you from any potential issues and help resolve disputes quickly.

5. Tracks Deductions and Expenses

Freelancers often have various business-related expenses, such as software subscriptions, office supplies, or travel costs for client meetings. Many of these expenses can be deducted from your taxable income, helping to reduce your tax liability.

A check stub maker can help track these expenses and deductions. You can include any business-related costs that have been deducted from your income, which helps ensure you’re properly accounting for them come tax season. This makes the process of calculating your taxable income much simpler and ensures you aren’t missing out on potential deductions.

How to Use a Check Stub Maker

Now that you understand the importance of using a check stub maker, let’s go over the process of creating check stubs and how you can use them to protect your earnings.

Step 1: Choose the Right Check Stub Maker

There are several online tools available to create check stubs. Some popular check stub makers include:

- 123PayStubs

- PayStubCreator

- QuickBooks Self-Employed

- PaycheckStubOnline

When choosing a check stub maker, it’s important to pick one that is reliable, user-friendly, and customizable. Look for features that allow you to:

- Customize your check stubs with your name, client name, and payment details

- Include tax deductions, business expenses, and other relevant information

- Download or print your check stubs for record-keeping

- Provide detailed reports that make tax filing easier

Step 2: Enter Your Information

Once you’ve chosen a check stub maker, the next step is to input your information. This typically includes:

- Your name and business name (if applicable)

- The client’s name and payment details (gross earnings)

- The work or services provided

- Deductions (such as taxes, retirement contributions, or insurance)

- Net pay (the final amount you take home after deductions)

- Pay period dates

Most check stub makers will guide you through this process, so you don’t have to worry about missing any important details.

Step 3: Customize Your Check Stub

Some check stub makers allow you to customize the design of your check stub. You can add your logo or choose from various templates to make the stub look more professional. Customizing your check stub can help you create a branded document that reflects your freelance business.

While customization isn’t required, it can help create a more professional look that clients and other parties will appreciate.

Step 4: Generate and Download Your Check Stub

Once all the details are in place, the check stubs maker will generate the check stub for you. You can download the stub as a PDF or other file format and save it to your computer or cloud storage. You can also print a copy for your records.

Be sure to store your check stubs in an organized manner so that you can easily reference them when needed. Cloud storage options like Google Drive, Dropbox, or OneDrive can help access your stubs from anywhere.

Step 5: Review and Keep Track of Your Check Stubs

After generating your check stubs, it’s important to review them regularly. Keep track of your earnings and make sure the details match the payment you received. You can use your check stubs to monitor how much you’ve been paid by each client and identify any overdue payments.

Keeping your check stubs organized will also help you prepare for tax season. By reviewing them periodically, you can make sure you’re properly tracking deductions and expenses and be ready when it’s time to file taxes.

Benefits of Using a Check Stub Maker

- Organization: Easily track all of your freelance earnings and keep everything in one place.

- Tax Preparation: Have detailed records ready for tax filing, ensuring you don’t miss any deductions or income.

- Proof of Income: Provide professional documentation of your earnings when applying for loans, credit, or housing.

- Protection: Safeguard yourself against disputes with clients by keeping a clear record of payments.

- Time-Saving: Quickly generate and store check stubs, freeing up more time for actual work.

Conclusion

Freelancing offers the opportunity for independence, but it also comes with unique financial challenges. By using a check stub maker, you can protect your earnings, stay organized, and ensure that you’re keeping accurate records of your income and expenses. Whether you’re tracking payments from multiple clients, preparing for tax season, or providing proof of income, check stubs play an essential role in managing your freelance business.

Using a check stub maker doesn’t just help with documentation; it empowers you to take control of your financial future. So, take the next step and start using a check stub maker today to protect your earnings and build a solid financial foundation for your freelance career..

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

How To Get Paystub From Zachary

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season