For tradespeople, from electricians and plumbers to carpenters and HVAC technicians, managing payroll is often one of the more complex aspects of running a business. Between juggling multiple jobs, working on-site, and keeping track of materials and tools, handling payroll can sometimes feel overwhelming. However, with the advent of modern tools like a paycheck generator, managing payroll on the go has become easier, faster, and more efficient.

A paycheck generator is a tool designed to simplify the process of creating accurate paychecks and pay stubs. It allows businesses—whether large or small—to automate payroll and ensure compliance with tax laws. For tradespeople, a paycheck generator is not just a time-saver but an essential tool that can streamline operations, boost accuracy, and provide a more organized way to track earnings and deductions.

In this blog, we’ll explore how a paycheck generator can help tradespeople manage payroll more efficiently, why it’s essential for staying compliant, and how it can help you focus more on the work you love rather than the paperwork.

What Is a Paycheck Generator?

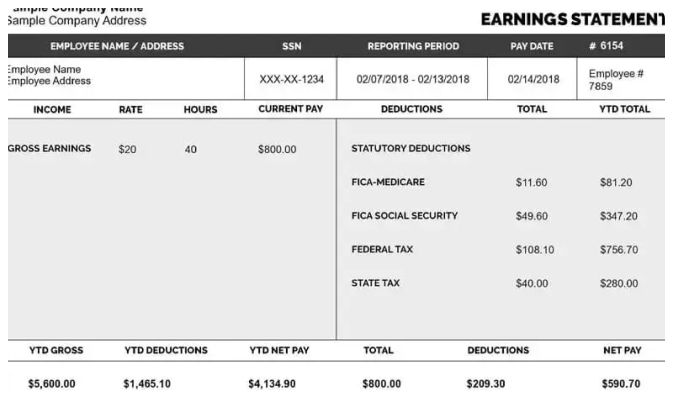

A paycheck generator is a digital tool or software that helps businesses create paychecks or pay stubs for their employees. It automatically calculates wages, taxes, deductions, and other withholdings based on the input you provide. Paycheck generators typically come with pre-designed templates that can be customized to suit the specific needs of your business.

For tradespeople, these tools can be a game-changer because they eliminate the need to manually calculate hourly rates, overtime, taxes, and other pay-related details. Instead, you can quickly generate accurate paychecks and ensure that your employees are paid on time and correctly, all from your mobile device or computer.

Why Tradespeople Need a Paycheck Generator

Running a trade business often means you’re working on multiple jobs across different locations. You might be on the move, meeting clients, and solving problems, which leaves little time for handling payroll. Here’s how a paycheck generator can help you stay on top of your business without getting bogged down in administrative tasks:

1. Simplicity and Time Savings

Tradespeople often deal with varying hours and job sites, so managing payroll can become a huge time-consuming task. A paycheck generator simplifies the process by automating many of the calculations involved in payroll.

- Automatic Calculations: The generator does all the math for you, calculating regular pay, overtime, taxes, and deductions. This eliminates the risk of human error, ensuring that employees get the correct pay every time.

- Save Time: Instead of spending hours manually calculating pay for each employee, a paycheck generator allows you to create paychecks in minutes. This frees up your time to focus on the work at hand—whether it’s fixing a leaky pipe, installing wiring, or repairing a roof.

2. Accuracy in Payroll

Accurate payroll is critical for maintaining trust with your employees. Mistakes in calculating wages, taxes, or deductions can cause frustration and lead to unhappy workers. A paycheck generator ensures that all calculations are correct by using up-to-date tax rates and rules.

- Correct Tax Deductions: The generator automatically calculates federal, state, and local tax deductions based on the employee’s earnings, which helps you comply with tax laws.

- Track Overtime: For tradespeople working overtime, a paycheck generator can calculate the additional pay automatically, ensuring that overtime hours are compensated correctly.

3. Compliance with Labor Laws

Labor laws, including tax regulations, can be complicated and vary by state. As a tradesperson, staying compliant with all of these laws is crucial to avoid fines and penalties. A paycheck generator helps you stay on the right side of the law by ensuring that your payroll calculations meet the required standards.

- State-Specific Requirements: Many paycheck generators are equipped to handle state-specific tax rates, withholding requirements, and other regulations. This ensures compliance no matter where your business operates.

- Accurate Recordkeeping: Most paycheck generators also provide a record of all paychecks generated. This can be useful for tax reporting, audits, or simply tracking payments for internal records.

4. Mobile Convenience for On-the-Go Tradespeople

As a tradesperson, you’re likely moving from one job site to another, making it difficult to stay on top of office tasks like payroll. A paycheck generator that’s mobile-friendly can help you manage payroll from anywhere—whether you’re in a truck, on a job site, or working from home.

- Access Anywhere: With a mobile-friendly paycheck generator, you can generate paychecks on the go, whenever you need them. Whether you’re working from your phone or tablet, you can manage payroll from virtually any location.

- Immediate Updates: Many paycheck generators allow you to make real-time updates. For example, if an employee works extra hours on a project or has a change in pay rate, you can quickly adjust their paycheck without delay.

5. Employee Transparency and Trust

Tradespeople often rely on subcontractors or small teams to help complete jobs. A paycheck generator can help foster trust with your employees by providing clear and professional pay stubs that detail their earnings, deductions, and other withholdings.

- Clear Breakdown: Employees appreciate transparency when it comes to their pay. A paycheck generator automatically provides a detailed breakdown of the employee’s hours worked, pay rate, taxes, and other deductions.

- Electronic Pay Stubs: Some paycheck generators offer the option of sending pay stubs electronically. This saves time and paperwork while providing employees with immediate access to their pay information.

6. Better Financial Tracking for Tradespeople

For tradespeople, keeping track of income and expenses is key to understanding the health of your business. A paycheck generator helps you maintain accurate financial records that can assist with budgeting, tax filing, and business planning.

- Easy Recordkeeping: A paycheck generator saves a digital record of all paychecks issued, making it easy to track your expenses over time. This is especially useful when filing taxes or preparing for an audit.

- Tax Season Simplified: Instead of scrambling to gather pay stubs and receipts come tax season, you’ll have all your payroll information neatly stored and accessible. This can reduce the stress of tax preparation and ensure you don’t miss any important deductions.

7. Customizable Features for Specific Needs

Each trade business is unique, and a one-size-fits-all approach to payroll might not work for you. A paycheck generator typically offers customizable features that can be tailored to your specific needs.

- Custom Pay Rates: Whether you pay by the hour, by the job, or offer commissions, a paycheck generator can be customized to accommodate your payment structure.

- Include Additional Deductions: Many paycheck generators allow you to add specific deductions, such as materials costs, union fees, or insurance premiums, so you can give your employees an accurate reflection of their take-home pay.

8. Streamlining Billing and Invoicing

As a tradesperson, managing both payroll and billing can sometimes feel overwhelming. Many paycheck generators offer integrated tools to streamline both processes.

- Integrated Invoicing: Some paycheck generators come with invoicing features, allowing you to easily send invoices to clients while also managing payroll for your workers.

- Automated Payroll Reports: You can also generate payroll reports that are synced with your invoicing, making it easier to keep track of your business’s financials.

How to Choose the Right Paycheck Generator for Your Trade Business

Not all paycheck generators are the same. Here’s what to consider when choosing the right one for your business:

- Ease of Use: Look for a paycheck generator that’s simple and intuitive. You don’t want to waste time learning complicated software, especially if you’re already busy running a business.

- Customization Options: Choose a generator that can be customized to suit the specific needs of your trade business. Whether it’s custom pay rates, overtime rules, or specific deductions, the software should be adaptable.

- Mobile-Friendly: Since you’re often on the go, make sure the paycheck generator is accessible via mobile devices. Many cloud-based systems allow for easy access from phones or tablets.

- Compliance Features: The paycheck generator should automatically update to reflect changes in tax rates and labor laws. This ensures that you stay compliant, no matter where you operate.

- Customer Support: If you encounter issues or have questions, reliable customer support is essential. Look for a paycheck generator with strong customer service options, whether via phone, email, or live chat.

Conclusion

For tradespeople, a free paycheck generator is a vital tool for managing payroll efficiently and accurately. It helps you save time, stay compliant, reduce errors, and maintain transparency with your employees. With its mobile capabilities, customizable features, and ease of use, a paycheck generator allows you to focus on what you do best—working in your trade—while taking care of the administrative side of your business.

Whether you’re a solo entrepreneur or manage a small team, a paycheck generator can streamline your payroll process, making it faster, easier, and more reliable than ever before.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown