Managing payroll can be a daunting task for freelance contractors. Unlike traditional employees, freelance contractors are responsible for managing their income, taxes, and financial records independently. This is where a payroll check maker becomes an invaluable tool. By automating payroll processes and providing clear documentation, these tools help freelancers streamline their financial management.

In this blog, we’ll explore how a free payroll check maker can simplify payroll management for freelance contractors, the benefits it offers, and how it works.

The Unique Payroll Challenges of Freelance Contractors

Freelance contractors face several challenges when it comes to managing their payroll:

1. Irregular Income

Freelancers often have inconsistent earnings, as their income depends on project-based work. This makes it essential to track payments accurately and manage fluctuations.

2. Tax Responsibilities

Unlike traditional employees, freelance contractors must calculate and pay their taxes. This includes self-employment tax, federal income tax, and sometimes state and local taxes.

3. Proof of Income

Freelancers frequently need proof of income for:

- Loan applications

- Renting apartments

- Financial planning

4. Time Management

Balancing client work with administrative tasks like payroll can be overwhelming. Freelancers need efficient tools to save time.

A free payroll check maker addresses these challenges by offering a simple, reliable solution for generating accurate pay stubs.

What Is a Free Payroll Check Maker?

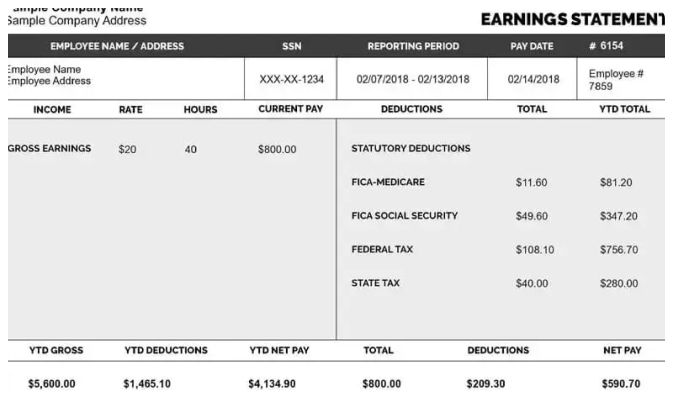

A free payroll check maker is an online tool that allows users to create professional pay stubs. By entering essential details like hours worked, pay rates, and deductions, freelancers can generate accurate payroll records quickly. These tools are especially useful for managing finances and meeting documentation needs.

Benefits of Using a Free Payroll Check Maker for Freelance Contractors

1. Accurate Payroll Records

Freelancers can use payroll check makers to create precise records of their earnings. This ensures they:

- Track payments from multiple clients.

- Keep organized financial records.

- Avoid errors in calculations.

2. Simplified Tax Preparation

Tax season can be stressful for freelancers. A payroll check maker simplifies tax preparation by:

- Providing a clear breakdown of income and deductions.

- Helping calculate tax liabilities accurately.

- Offering a detailed record of earnings for tax filing.

3. Professionalism

Freelancers who issue professional pay stubs to clients or keep detailed records for themselves appear more credible. A payroll check maker creates polished, professional-looking pay stubs that:

- Reflect reliability.

- Build trust with clients.

4. Time Savings

Manual payroll calculations can be time-consuming. A free payroll check maker streamlines the process, allowing freelancers to:

- Spend less time on administrative tasks.

- Focus more on delivering high-quality work to clients.

5. Budget Management

Freelancers can use pay stubs to better understand their income and expenses. This helps them:

- Plan for tax payments.

- Save for business investments.

- Manage personal finances more effectively.

How a Free Payroll Check Maker Works

Using a payroll check maker is straightforward. Here’s a step-by-step guide:

1. Input Personal Information

Start by entering:

- Your name and contact details.

- The client’s name and contact details (if applicable).

2. Enter Payment Details

Provide details like:

- Total hours worked.

- Hourly rate or project fee.

- Any additional earnings (e.g., bonuses).

3. Include Deductions

Input any necessary deductions, such as:

- Taxes

- Health insurance contributions

4. Review and Generate

Double-check the information for accuracy and generate the pay stub. The final document will include:

- Gross pay

- Deductions

- Net pay

5. Save or Print the Pay Stub

Save a digital copy for your records or print it for physical documentation.

Key Features of a Free Payroll Check Maker

When selecting a payroll check maker, look for these essential features:

1. Customizable Templates

The tool should allow you to tailor pay stubs to meet your needs, including:

- Adding company logos.

- Customizing fields.

2. User-Friendly Interface

Choose a tool that is intuitive and easy to navigate, even for users without payroll experience.

3. Automatic Calculations

Ensure the tool automatically calculates:

- Gross pay

- Deductions

- Net pay

4. Data Security

Select a platform that prioritizes data protection to keep your financial information secure.

5. Mobile Accessibility

A mobile-friendly tool lets you manage payroll on the go, which is ideal for busy freelancers.

Real-Life Scenarios: How Freelancers Benefit from a Payroll Check Maker

1. Managing Multiple Clients

Freelancers often juggle multiple projects for various clients. A payroll check maker helps them:

- Track payments from each client.

- Maintain separate records for each project.

2. Preparing for Tax Season

By using pay stubs generated by a payroll check maker, freelancers can:

- Quickly access income records.

- Avoid scrambling for information during tax season.

3. Securing Loans or Rentals

Freelancers often face challenges proving their income. Pay stubs created with a payroll check maker provide clear documentation, making it easier to:

- Apply for personal or business loans.

- Rent apartments or office spaces.

4. Budgeting for Business Expenses

Freelancers can use pay stubs to:

- Track earnings and plan budgets.

- Save for future business expenses, like new equipment or software.

Popular Industries for Freelance Contractors

While a free payroll check maker is valuable for all freelancers, certain industries benefit the most:

1. Creative Professionals

Freelance designers, writers, and artists often work on multiple projects. A payroll check maker helps them organize payments and track income.

2. Construction and Trades

Independent contractors in construction need detailed records for their work hours and payments.

3. Technology

Freelance developers and IT consultants often bill clients hourly, making accurate payroll records essential.

4. Consulting

Freelance business consultants can use payroll check makers to generate professional pay stubs for their services.

Conclusion

A free payroll check maker is an essential tool for freelance contractors looking to simplify payroll management. By providing accurate records, saving time, and ensuring professionalism, these tools empower freelancers to take control of their finances. Whether you’re a creative professional, a tech consultant, or a tradesperson, using a payroll check maker can streamline your operations and help you focus on growing your freelance career.

Start using a free payroll check maker today and experience the difference it can make in managing your income and payroll responsibilities.