In the modern workplace, employee satisfaction is a key metric that directly influences productivity, retention, and overall company success. While many organizations focus on perks like flexible hours, wellness programs, or team-building activities, one critical yet often overlooked factor is payroll transparency. This is where paystub creators come into play—offering employees clarity, consistency, and control over their finances.

Paystub creators, such as real check stubs tools, are more than just financial documentation generators; they are pivotal in creating trust between employers and their workforce. Let’s dive into how these tools can significantly impact employee satisfaction and why they should be a staple in every business.

What Is a Paystub Creator?

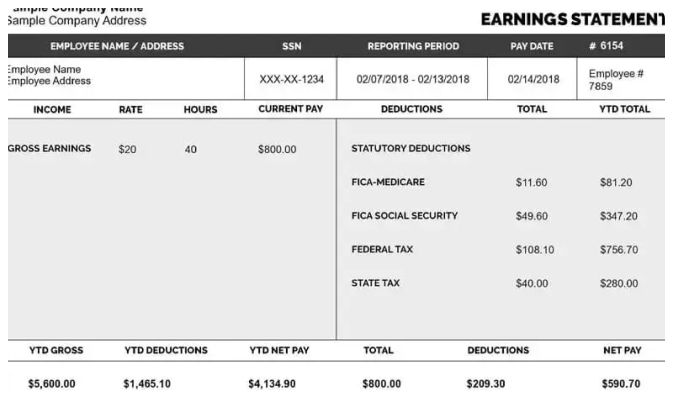

A paystub creator is a digital tool that allows businesses and individuals to generate detailed and accurate paystubs. These documents typically include crucial information such as:

- Employee name and ID

- Gross earnings

- Taxes and deductions

- Benefits contributions

- Net pay

- Year-to-date (YTD) totals

Unlike traditional methods of creating paystubs manually or using complex accounting software, paystub creators streamline the process. Tools like real check stubs are user-friendly, affordable, and ensure compliance with legal requirements for payroll documentation.

How Paystub Creators Improve Employee Satisfaction

1. Transparency in Payroll

Employees want to understand how their earnings are calculated. A detailed paystub from a reliable paystub creator eliminates confusion by breaking down every component—from gross pay to taxes and deductions. Transparency fosters trust and reduces misunderstandings about payroll discrepancies.

2. Financial Awareness and Empowerment

Paystub creators empower employees by providing a clear snapshot of their financial situation. With access to real check stubs, employees can:

- Track overtime pay and bonuses

- Monitor tax withholdings

- Plan for retirement contributions

- Ensure deductions for benefits like healthcare are accurate

This financial awareness helps employees make informed decisions about their personal finances, leading to greater peace of mind.

3. Timely and Accurate Payments

Late or inaccurate payments can be a significant source of frustration for employees. Paystub creators automate the process, ensuring timely and precise payroll management. Employees can rest assured that they will be paid accurately and on time, enhancing their job satisfaction.

4. Customizable Options for Diverse Workforces

Modern workplaces often have diverse payroll needs, especially if they employ freelancers, part-time workers, or commission-based employees. Paystub creators, like real check stubs, offer customizable templates to accommodate various employment types. This flexibility ensures that every employee receives a paystub tailored to their specific role and compensation structure.

5. Year-to-Date Tracking for Better Financial Planning

YTD tracking is a feature included in most paystub creators. Employees can see their cumulative earnings, taxes, and deductions for the year, making it easier to:

- File taxes accurately

- Budget for upcoming expenses

- Plan for end-of-year financial goals

Having this information readily available reduces stress and promotes a sense of control over personal finances.

Why Businesses Should Invest in Paystub Creators

While the benefits for employees are clear, businesses also gain significant advantages by incorporating paystub creators into their operations. Here’s why:

1. Enhanced Compliance

Payroll regulations vary across states and industries. Paystub creators ensure that businesses remain compliant with local, state, and federal laws by providing accurate and legally compliant documentation. Tools like real check stubs keep employers protected from potential audits or legal issues.

2. Reduced Administrative Burden

Manually creating paystubs is time-consuming and prone to errors. Paystub creators automate the process, freeing up valuable time for HR and payroll departments. This efficiency allows businesses to focus on strategic initiatives rather than administrative tasks.

3. Cost-Effective Solution

Investing in a paystub creator is far more affordable than hiring additional payroll staff or purchasing expensive accounting software. Small businesses, in particular, benefit from the budget-friendly nature of tools like real check stubs.

4. Improved Employee Retention

Satisfied employees are more likely to stay with a company. By providing clear, accurate, and timely paystubs, businesses demonstrate that they value their workforce, ultimately reducing turnover rates.

5. Professionalism and Trust Building

Providing professional paystubs enhances the company’s reputation. Employees perceive the organization as organized, reliable, and employee-focused, strengthening trust and loyalty.

Target Audience for Paystub Creators

1. Small Business Owners

Small business owners often juggle multiple responsibilities, including payroll. Paystub creators simplify this process, allowing them to manage payroll efficiently without hiring extra help.

2. Freelancers and Self-Employed Individuals

Freelancers and independent contractors need paystubs to verify income for loans, leases, or taxes. Tools like real check stubs enable them to create professional pay documentation quickly and easily.

3. HR and Payroll Professionals

HR and payroll departments in medium to large enterprises can benefit from paystub creators by automating repetitive tasks and ensuring compliance.

4. Employees in Gig Economy

Workers in the gig economy often have irregular income. Paystub creators help them document their earnings accurately, which is essential for financial stability and planning.

How to Choose the Right Paystub Creator

When selecting a paystub creator, consider the following factors:

- Ease of Use Look for tools that are intuitive and require minimal training.

- Customization Options Ensure the software offers customizable templates to suit various employment types and industries.

- Accuracy and Compliance Choose a tool that guarantees accurate calculations and compliance with payroll laws.

- Affordability Select a solution that fits your budget without compromising on quality.

- Customer Support Opt for a provider with reliable customer support to address any issues or questions promptly.

Real Check Stubs: A Trusted Paystub Creator

Among the many paystub creators available, real check stubs stands out as a reliable and user-friendly option. It offers:

- Easy-to-use templates for various job roles

- Accurate calculations with compliance features

- Affordable pricing plans for individuals and businesses

- Instant delivery of professional paystubs

Real check stubs cater to the needs of small businesses, freelancers, and large organizations alike, making it a versatile choice for anyone looking to enhance payroll transparency and efficiency.

Conclusion

Employee satisfaction is a multifaceted goal, but payroll transparency plays a surprisingly significant role in achieving it. free Paystub creator, like real check stubs, are an invaluable tool for fostering trust, promoting financial awareness, and ensuring accurate and timely payroll management.

By investing in these tools, businesses can improve employee morale, enhance retention, and streamline payroll processes. Whether you’re a small business owner, a freelancer, or part of a larger organization, incorporating a paystub creator into your operations is a simple yet impactful way to boost satisfaction and trust in the workplace.

Related Articles

How to Access Your MyHTSpace Pay Stub?

How to Get a Check Stub From TruBridge?

Everything You Need to Know About Your Ford Paycheck Stubs

How to Obtain Hobby Lobby Pay Stubs: A Detailed Guide

The Importance of Tracking Your Family Dollar Paystub for Tax Season

What is an eStub and How Does It Simplify Payroll Management?

How Does Verizon Paystub Help Ensure Payroll Accuracy and Transparency?

Understanding Your Pasadena Unified Paystub: A Quick Breakdown