How RussianMarket Credit Card Sales Are Affecting Online Businesses

**Title: How RussianMarket Credit Card Sales Are Affecting Online Businesses**In the fast-paced realm of e-commerce, understanding the pulse of payment trends can make or break an online business. Enter russian-market.cc a rising star in the world of digital transactions that has been turning heads and reshaping shopping behavior across borders.

As sales soar and shoppers embrace this new platform, businesses everywhere are left wondering: what does this mean for their bottom line? In this blog post, we’ll delve into how the surge in RussianMarket credit card sales is not only influencing consumer habits but also rewriting the rules for online enterprises around the globe. Buckle up as we explore strategies to adapt and thrive amid these exciting changes!

Introduction to the Russian market and its growing impact on online businesses

The Russian market is steadily gaining traction in the global online business landscape. With a population of over 144 million and an increasing number of internet users, Russia presents a unique opportunity for e-commerce growth. As more consumers turn to digital platforms for shopping, understanding how credit card sales function within this market becomes crucial.

Online businesses that tap into the russian-market.cc can unlock significant revenue streams, but they must navigate distinct characteristics that set it apart from other regions. So what does it take to thrive in this dynamic environment? Let’s dive deeper into the nuances of credit card sales in Russia and explore how they’re shaping opportunities for online enterprises eager to expand their reach.

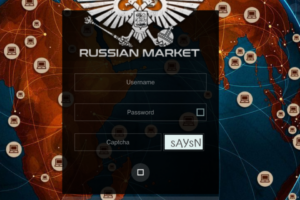

A Screenshot of Russianmarket (Russian-market.cc) login page

Explanation of credit card sales in Russia and how it differs from other markets

Credit card sales in Russia present a unique landscape. Unlike many Western markets, where credit cards dominate transactions, Russia has its own distinct trends.

A notable difference is the prevalence of local payment systems. The Mir payment system emerged as a response to international sanctions, gaining traction among consumers and merchants alike. This shift underscores a growing preference for national solutions over foreign alternatives.

Additionally, Russianmarket consumers tend to favor debit cards more than credit options. It reflects broader economic behaviors shaped by historical factors and financial literacy levels.

Security concerns also play a significant role in shaping preferences. Many Russians prioritize secure transaction methods due to past experiences with fraud.

These nuances create both opportunities and challenges for online businesses looking to tap into the Russian market. Understanding these differences is crucial for success in this rapidly evolving environment.

Benefits of targeting the Russian market for online businesses

Targeting the Russian market offers a wealth of opportunities for online businesses. With over 100 million internet users, Russia boasts one of the largest digital markets in Europe.

Consumers are increasingly turning to e-commerce. They appreciate convenience and variety, which presents a perfect avenue for businesses to tap into this growing demand.

Additionally, the purchasing power among certain demographics is rising. This shift means more potential customers willing to spend on international goods and services.

Moreover, adapting marketing strategies for local preferences can yield impressive returns. Customized approaches resonate better with Russian consumers.

Cultural nuances play a significant role in engagement levels too, making it essential for brands to connect authentically with their audience. Embracing these factors can create lasting brand loyalty within this vibrant market sector.

Challenges and limitations of accepting credit card payments in Russia

Accepting credit card payments in Russia presents distinct challenges for online businesses. One significant hurdle is the high rate of fraud associated with Russian transactions. This often leads to increased scrutiny and a cautious approach from payment processors.

Another limitation is the complex regulatory environment. Different banks have varying requirements, which can complicate compliance for international sellers. This inconsistency can delay transactions or even result in declined payments.

Additionally, many Russian consumers prefer local payment methods over traditional credit cards. As a result, businesses that solely focus on credit card acceptance may miss out on eager customers who favor alternative solutions.

Currency fluctuations also play a role in this market’s unpredictability. Businesses must navigate these shifts carefully to protect their profit margins while remaining competitive. Understanding these challenges is crucial for any company looking to thrive within the Russian Market landscape.

Tips for successfully navigating the Russian credit card market

Understanding the Russian credit card market requires a nuanced approach. Start by familiarizing yourself with local regulations and compliance requirements. This knowledge is crucial for seamless transactions.

Partnering with established payment processors in Russia can streamline your operations. These companies often have insights into consumer behavior, which can help tailor your offerings to meet local preferences.

Localization of your website is vital. Ensure that all content, including checkout processes, is translated accurately into Russian. A user-friendly experience builds trust and encourages purchases.

Consider integrating popular Russian payment systems like Qiwi or Yandex.Money alongside traditional credit card options. Offering varied payment methods caters to different customer needs and enhances conversion rates.

Lastly, monitor trends regularly. The financial landscape in Russia evolves quickly, so staying updated on consumer habits will keep you competitive in the ever-changing market dynamics.

Case studies and success stories of businesses thriving in the Russian market

Several businesses have found remarkable success in the RussianMarket. One notable example is an e-commerce platform specializing in fashion. By localizing their website and offering popular payment methods, they quickly gained a loyal customer base.

Another success story comes from a tech startup that focused on digital solutions for small businesses. They tapped into Russia’s demand for innovative software, making it easy for users to adopt new technologies. Their tailored approach led to rapid growth and market recognition.

Additionally, an international cosmetics brand capitalized on social media marketing strategies tailored to Russian consumers. Engaging influencers helped them connect with local audiences effectively.

These examples highlight how understanding cultural nuances and consumer preferences can lead to impressive results in the RussianMarket context. Businesses willing to adapt and innovate are reaping significant rewards.

Alternatives to credit card sales in Russia: exploring other payment methods

While credit cards are prominent in Russia, they’re not the only payment option available. Many consumers prefer alternative methods that suit their needs and preferences.

E-wallets have gained popularity, with services like Yandex.Money and Qiwi leading the pack. These platforms offer quick transactions and added layers of security. Users can easily make purchases without relying solely on traditional banking systems.

Bank transfers also play a significant role. Russian buyers often favor direct transfers for larger sums or when shopping from international sites. This method builds trust but requires patience during processing times.

Mobile payments are on the rise too. Apps such as Sberbank Online provide convenience for users who want seamless shopping experiences through their smartphones.

Cryptocurrencies are emerging as another viable option, appealing to tech-savvy shoppers looking for anonymity and freedom from conventional financial institutions.

Potential future developments in the Russian credit card market and its effects on online businesses

The Russianmarket to credit card market is poised for significant evolution. With advancements in technology, digital wallets are gaining traction among consumers. This shift could reshape payment preferences dramatically.

Furthermore, financial regulations are becoming more streamlined. The government is focusing on enhancing security measures and reducing fraud, which will likely boost consumer confidence in online transactions.

Emerging fintech companies are also entering the scene. These startups may introduce innovative payment solutions tailored specifically to local needs and preferences.

As competition increases, established banks might adapt by offering better terms and lower fees. This could lead to a more vibrant ecosystem beneficial for both businesses and customers alike.

Moreover, collaborations between international brands and local firms may foster growth opportunities across various sectors. Embracing these changes can empower online businesses looking to expand their reach within Russia’s dynamic marketplace.

Conclusion: Is it worth it for online businesses to tap into the Russian market?

Tapping into the russian-market.cc presents both exciting opportunities and formidable challenges for online businesses. With a growing population of tech-savvy consumers, the potential customer base is vast. The unique dynamics of credit card sales in Russia can open doors to new revenue streams.

However, it’s essential to approach this market with caution. Understanding local preferences and payment options becomes crucial. Companies that adapt their strategies tend to find success, while those that don’t may struggle.

Navigating regulatory hurdles is another vital aspect for international businesses considering expansion into Russia. Keeping abreast of changing laws and consumer behaviors will be key to thriving in this landscape.

For many online entrepreneurs, the question remains whether the benefits outweigh the risks when entering this complex yet promising market. Each business must weigh its capabilities against these factors before making a decision on whether or not to pursue opportunities within RussianMarket.