The implementation of ZATCA (Zakat, Tax, and Customs Authority) e-invoicing regulations in Saudi Arabia has reshaped how businesses handle invoicing and tax compliance. With the transition to a fully digital invoicing system, companies are required to submit their invoices electronically, ensuring they meet the standards set by ZATCA. The best accounting software in Saudi Arabia plays a crucial role in simplifying ZATCA e-invoicing, offering automated solutions that ensure businesses adhere to these regulations seamlessly. These software tools are designed to reduce manual efforts, enhance accuracy, and streamline the process of generating and submitting e-invoices.

Simplifying ZATCA e-invoicing with advanced accounting software is essential for businesses looking to avoid errors and penalties associated with non-compliance. The best accounting software in Saudi Arabia simplifies ZATCA e-invoicing by automatically incorporating necessary information such as VAT details, invoice numbers, and buyer and seller information, directly into the e-invoice templates. This automation eliminates the possibility of manual data entry errors, saving valuable time and resources. By integrating with other business systems, such as ERP and CRM, top accounting software ensures that data is updated in real time, further simplifying ZATCA e-invoicing and maintaining compliance. This seamless integration between systems ensures the accuracy and timeliness of invoice submissions, while reducing the administrative burden on businesses.

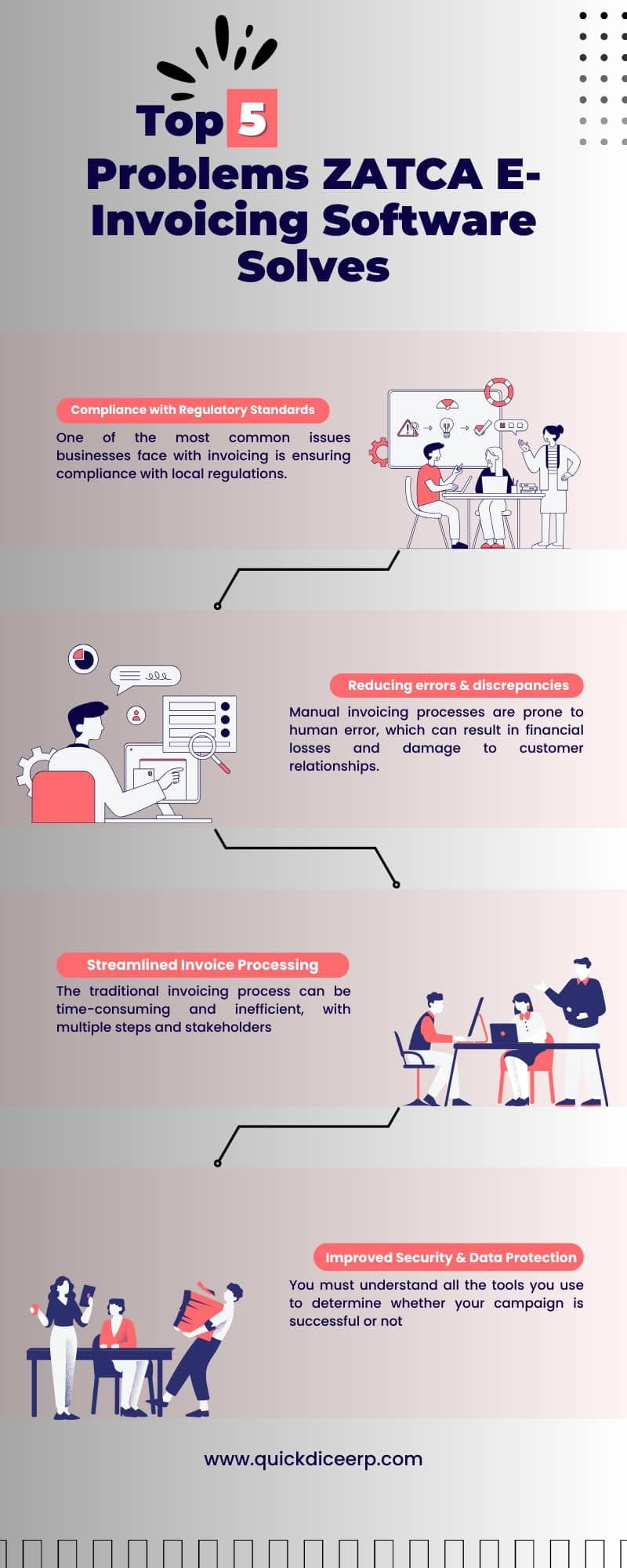

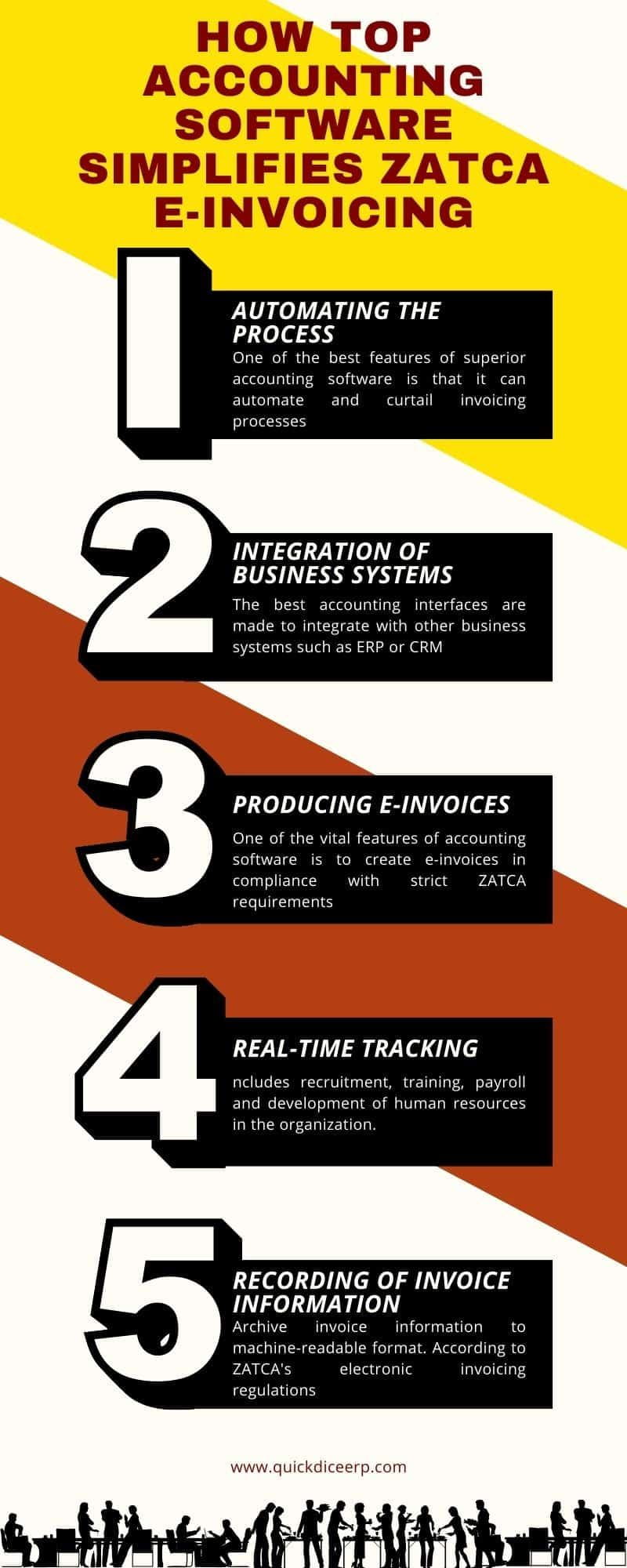

Here Are Some Ways Top Accounting Software Simplifies ZATCA E-Invoicing

1. Automating the Process: Reducing Manual Data Entry and Errors

One of the best features of superior accounting software is that it can automate and curtail invoicing processes, which greatly reduces the instances of manual data entry. Previously, businesses had to enter every transaction detail manually, and the whole exercise proved time-consuming and bore the high risk of human error. This could have resulted in the issuance of an incorrect invoice, delay in payment, and the risk of tax non-compliance.

With accounting software, a business can automate the invoice creation process using the transaction data entered in the systems; that is, the business can automatically generate invoices for sales of products, services rendered, or terms of contract. The software automatically pulls this data into the invoice template, hence without manual input. This not only speeds up the process but also largely reduces the chances of clerical errors such as wrong figures, badly spelled names of customers, incorrect assessments of VAT, etc.

This feature allowed for automatic generation of accurate and speedy invoices to clients by the businesses, thereby eliminating errors from the human interface and enhancing efficiency in service provision. This is most important for businesses that must submit electronic-compliant invoices to the ZATCA in real-time; the reasons being that they will face penalties or delays in approval due to discrepancies or errors. Hence, with automated accounting solutions, organizations have a higher standard of accuracy in streamlining their complete invoicing processes.

2.The integration of business systems: Ensuring Compliance with ZATCA Standards and Regulatory Changes.

The best accounting interfaces are made to integrate with other business systems such as ERP or CRM or incoming stock management systems. This integration causes the total transaction information passing between departments to form accurate, timely invoicing.

The invoicing-system connects all other important business systems from the sales area to purchases,

Stock and Accounting Data, so that they are in sync with the latest. This is critical for ZATCA compliance in obligatory e-invoicing, as segregated systems lead to errors within the e-invoice submissions. Integration of business systems brings the additional benefit of invoice generation with updated prices, tax rates, and discounts that characteristically change with regulatory factors.

Instituted updated requirements for invoicing from ZATCA in line with technological and regulatory developments. The best of the myriad accounting software solutions provides built-in features that update automatically in sync with the new regulatory guidelines from ZATCA, which in turn makes the organization compliant without manual intervention and lessens the administrative burden on organizations that would need to keep track of all changes within regulations manually.

3. Producing e-Invoices That Are Not Only Compliant but Also Accurate as per ZATCA Specifications

One of the vital features of accounting software is to create e-invoices in compliance with strict ZATCA requirements. According to ZATCA, all invoices must include certain data elements, such as buyer and seller information, invoice number as well as the invoice date and VAT details and lastly a unique QR code. The top accounting software automatically includes each of these elements when generating invoices so that businesses do not incur penalty mistakes.

This software calculates the exact VAT and ensures that any tax data is compliant with the current ZATCA specifications. Since taxation is automatic, businesses can be sure they are charging the right tax rates, which is necessary for avoiding audits or penalties from ZATCA.

More so, this software generates invoices in the mandated machine-readable format, such as XML and JSON, to ensure that data is easily integrated into the systems of ZATCA for validation. Such automation reduces administrative burden and saves the businesses from submitting tax non-compliant invoices, which may result in delays or penalties related to compliance.

4. Real-Time Tracking is Providing Status Updates and Reconciliation.

Here is another major benefit that comes with advanced accounting software, especially as simplifies ZATCA E-Invoicing: Status updates on e-invoices can be tracked in real time. ZATCA’s e-invoicing system requires businesses to submit invoices electronically and receive a report on their acceptance status. The major advantage of this is making possible real-time tracking by which businesses can always know whether submitting their invoices has resulted in approval or rejection. This in turn makes it quite easy to take appropriate action when this happens.

For example, the accounting software allows the user to view all invoices already submitted and the status of those invoices. Users receive notifications for successful submissions, pending approvals, rejections, and more. This feature makes it possible for businesses to redress the issues early enough before they grow bigger and more complicated, such as invalid data or missing information. Cash flow management now gets a step better with up-to-the-minute tracking: companies can view the status of each invoice and take timely follow-ups on overdue payments.

Furthermore, it facilitates the reconciliation process since invoices are now automatically matched against received payments and checked for accuracy within the records. Thus, reconciliation becomes automatic and avoids tedious, time-consuming actions involving false entries.

5. Recording of Invoice Information:

Archive invoice information to machine-readable format. According to ZATCA’s electronic invoicing regulations, companies will store invoice data in a secure file, one readable by machine, during the prescribed time. This ensures quick access for audits and easy retrieval when authorities request it. Most of the best accounting software solutions offer built-in features that automatically archive e-invoice data in a secured and compliant manner.

Such systems secure invoices in formats like XML or JSON. These formats are easy to retrieve and useful for audits or reconciliation. Most software will also facilitate backing documents for businesses, creating an added layer of protection against potential data loss.

Archiving organizes all transactions into records that are easy to access for tax reporting, financial audits, and more. By storing records electronically, enterprises ensure compliance with ZATCA retention requirements. This approach relieves users of worries about penalties caused by improper storage.

Conclusion

To finalize, the best accounting software in Saudi Arabia would break ZATCA e-invoicing into easy pieces. Top-class accounting software would obviously feature a variety of automated tools that will ease the processes, reduce errors, and ensure compliance as everyone strives to adhere to the rigorous norms laid down by ZATCA in terms of invoice handling. This kind of software allows businesses to generate e-invoices that are compliant automatically, archive details of the invoice automatically, and check the status of each invoice in real-time by integrating with existing business systems. These automated tools help businesses avoid costly penalties and errors often caused by manual invoice workflows.

Thus, the best accounting software in Saudi Arabia simplifies e-invoicing from ZATCA to a level that creates an efficient end-to-end invoicing process to solve the intricacies that come with VAT and other tax regulations. Most of this software reduce the tedious manual data entry and integrate business systems with real-time tracking and reconciliation of invoices, thereby saving time and money for businesses. The best accounting software thus take care of the requirement of the compliance that all e-invoices must satisfy under ZATCA, allowing businesses to keep track of changes in regulations while maintaining financial integrity. E-invoicing simplifies processes and ensures compliance, enabling companies to focus on expansion. With automated invoicing aligned to ZATCA standards, businesses can operate efficiently.