With Saudi Arabia gradually integrating its financial sector to the digital economy, e-invoicing in Saudi Arabia is mandatory in the whole kingdom. When implemented and managed by the Zakat, Tax, and Customs Authority or ZATCA, this system was meant to enhance operation transparency, combat tax fraud, and enhance the invoicing process. As the compliance is fully implemented in the companies, the e-invoice should be created and stored in the format and all the financial transactions should be reported to the government. This exercise is in sync with the government’s Vision 2030 plan of changing the economy and incorporating technological advancement in their activities.

Therefore, it is very crucial to check that the kind of e-invoices you are issuing are legal to avoid receiving penalties, having interruptions or delayed processing of payments. Whether your business is in Riyadh or any other city, legal and correct e-invoicing is important for the sound financial and operational conduct of the business. In the following guide, you will understand the basic steps to undertake in order to ensure that your e-invoices are in line with the current regulation governing e-invoicing in Saudi Arabia.

Here are the Steps to Ensure Your E-Invoices Meet Saudi Regulations

1.Understand the Phases of E-Invoicing in Saudi Arabia

2. Choose a Compliant E-Invoicing System

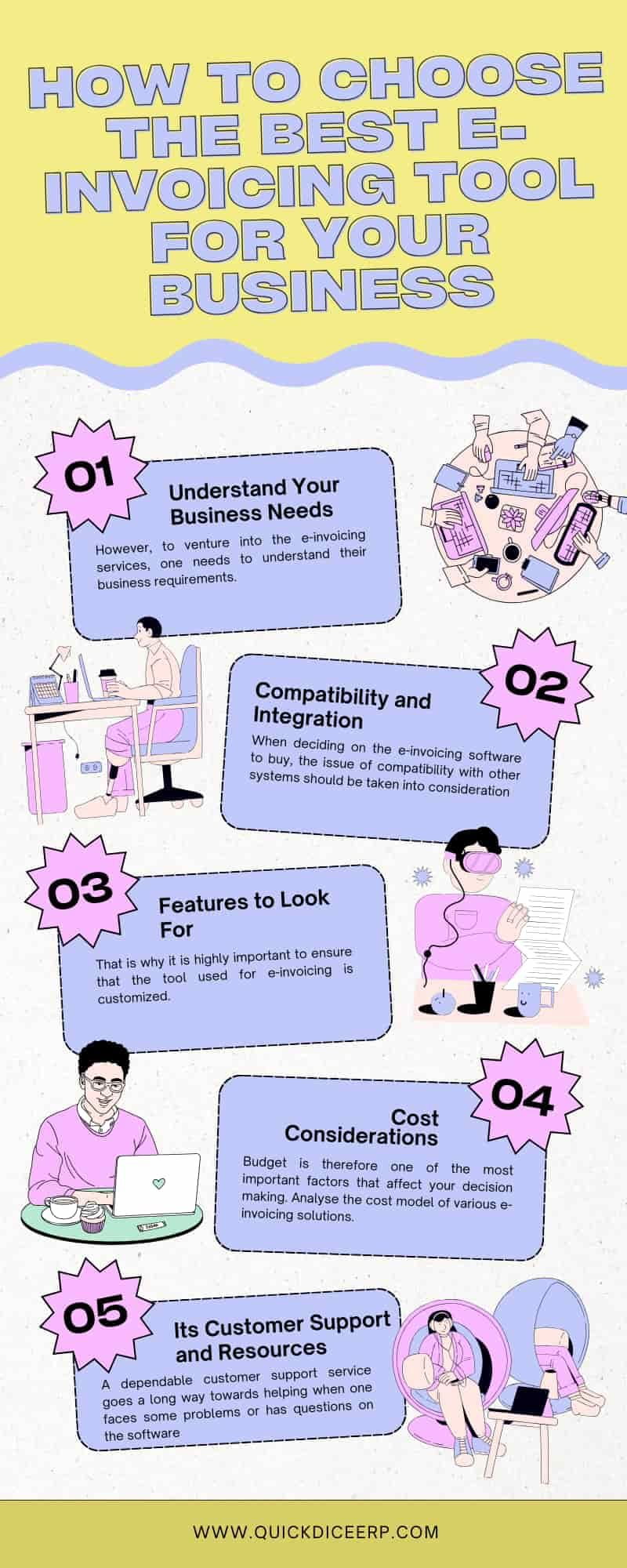

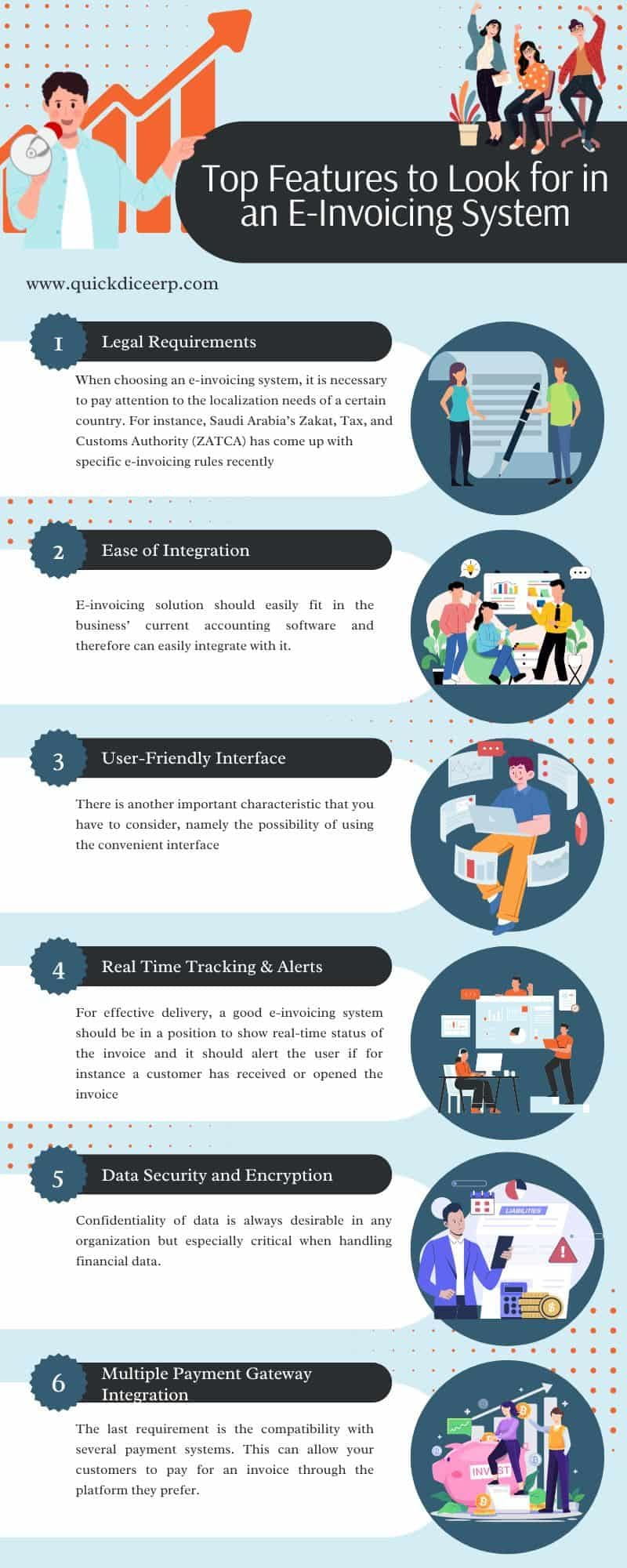

Selecting the right e-invoicing software is very important in order to meet the requirements set by the Saudi authority. The system you implement to produce the invoices must be able to produce the invoices in the format specified by ZATCA including XML or PDF/A-3 and meet all the other technical and legal requirements as provided by the ZATCA. A compliant system should also have to work with your existing accounting processes minimising the manual effort keeping data transfer accurate and compliant with all standards.

3. Verify VAT Compliance

The e-invoicing system in Saudi Arabia must adhere to VAT standards. Every e-invoice must reflect the current VAT charges and rates. This means including the correct VAT registration number and applying the appropriate VAT rate on all standard-rated supplies. Non-compliance with VAT laws can result in fines or delays. Therefore, businesses should regularly verify that their invoicing systems comply with VAT regulations.

4. Implement Digital Signatures and Archiving Procedures

From Phase 2 of Saudi Arabia’s e-invoicing rules, the e-invoicing systems of businesses must be capable of integrating themselves in real-time with the ZATCA platform. Such real-time connection enables automatic generation of invoices’ reports and submission to the authority to enhance on the transparency and compliance. Upgrading to new systems must occur well before the Phase 2 implementation to avoid connectivity issues during the upgrade.

6. Monitor Updates to Saudi Regulations

Similar to many other aspects of the Saudi financial system, Saudi e-invoicing regulations can still be under development. In order to deal with noncompliance, one has to have to update with all the regulations in order to be aware with the current laws so that one can be in compliance with the law. After that, you can track possible changes by listening to government announcements or consulting compliance professionals and your software vendor. This ensures your e-invoicing system stays updated with new changes without much disruption.

Conclusion:

Thus, the shift of the trend toward the use of e-invoicing in KSA is a positive development for the Saudi Arabia process of digitalization in order to enhance the efficiency, openness and compliance in other financial activities. In this way it will be possible for businesses to comprehend the stages of e-invoicing, determine a compliant system, check VAT and apply digital signatures in order to adapt to the continually evolving regulations. Such an environment is essential to combat when implementing and evolving the e-invoicing in Riyadh and to maintain a constant flow of interaction with ZATCA and updates on legal changes in the region.

Hence, it is essential for any organisation in Riyadh and across the Kingdom to successfully engage in the e-invoicing regulation to avert disruption, penalty, and delay on their financial transactions. These outlined steps are going to enhance the companies’ total compliance to the legislation of Saudi Arabia in the invoicing process. It is not only going to help to avoid legal issues but also enhance the company’s financial reporting and efficiency.