After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. An accounting guideline which allows the readers of financial statements to assume that the company will continue on long enough to carry out its objectives and commitments. In other words, the accountants believe that the company will not liquidate in the near future. This assumption also provides some justification for accountants to follow the cost principle. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). This Accounting Test is designed to help you assess your knowledge of essential accounting principles and basic concepts.

Get in Touch With a Financial Advisor

Share with classmates or export to Excel and your learning management system. Take your learning and productivity to the next level with our Premium Templates. After you have answered all 20 questions, click “Grade This Quick Test” at the bottom of the page to view your grade and receive feedback on your answers. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Finance Strategists has an advertising relationship with some of the companies included on this website.

Quiz 5: Basic Accounting Principles Quiz

- As a result, the accountant can continue to report most assets at their historical cost and can defer some costs to future periods.

- The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received).

- Try out these quiz questions and answers and check your financial knowledge.

- The result is that the company’s balance sheet will report the combined cost of two parcels at $310,000.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

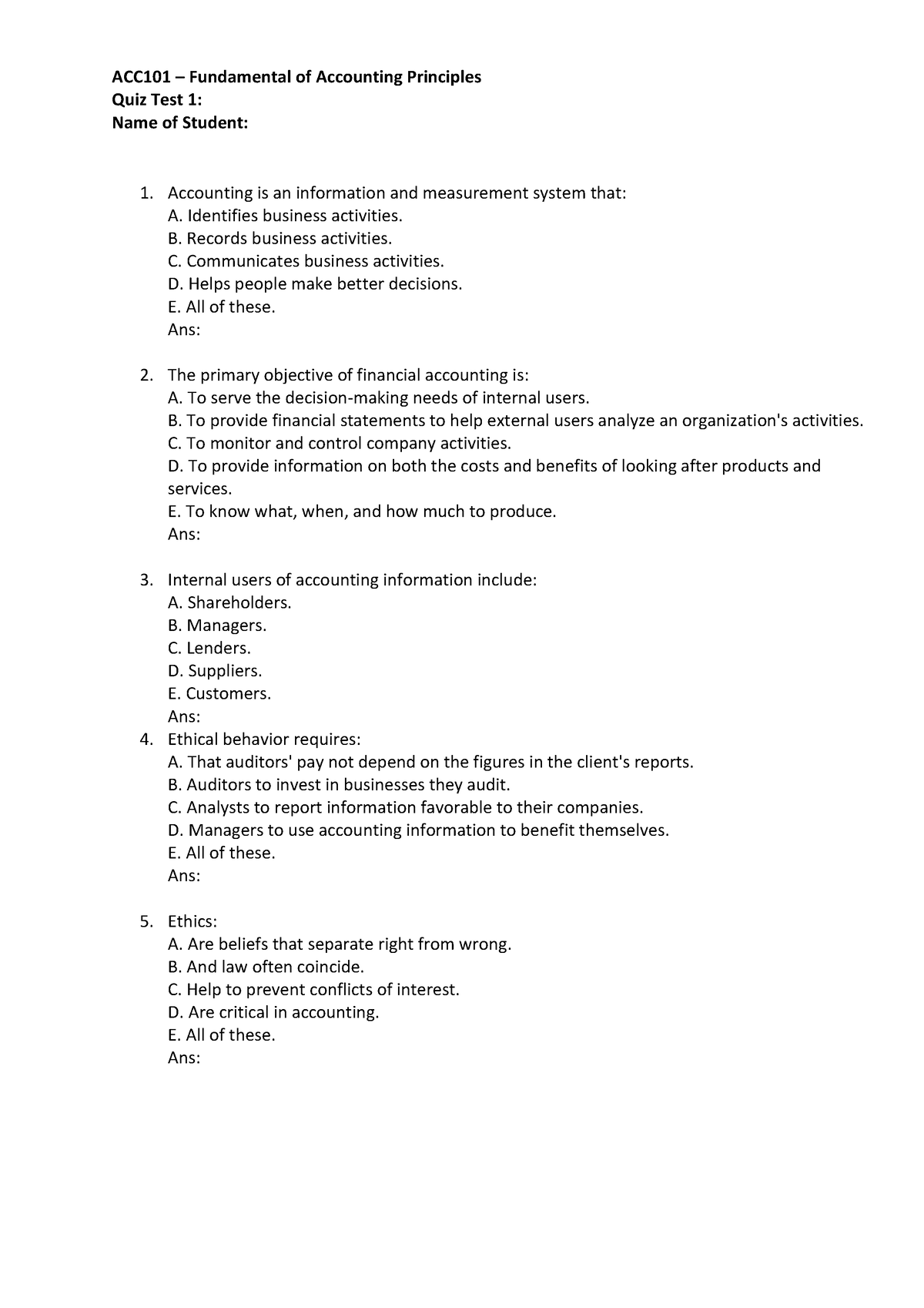

Test your knowledge on the different types of accounts, the basic principles of accounting including the double-entry system, and the main financial statements like the balance sheet and income statement. This quiz covers essential concepts necessary for understanding accounting fundamentals. There’s no need to feel confused about instructions 2020 these basic accounting principles or stressed out because you feel like there’s never enough time to finish all the questions on your accounting quizzes and tests. My students efficiently solve accounting problems with confidence in the allotted time. And I can show you how to do this too with Pass Accounting Class Resources.

To Ensure One Vote Per Person, Please Include the Following Info

Some of the factors that may be considered include the company’s financial position, Cash Flow, profitability, and business strategy. A nongovernment group of seven members assisted by a large research staff which is responsible for the setting of accounting standards, rules, and principles for financial reporting by U.S. entities. Since 1973, US GAAP has been developed and maintained by the Financial Accounting Standards Board (FASB), a non-government, not-for-profit organization.

Accountants are expected to apply accounting principles, procedures, and practices consistently from period to period. If a change is justified, the change must be disclosed on the financial statements. In this explanation we begin with brief descriptions of many of the underlying principles, assumptions, concepts, and qualities upon which the complex and detailed accounting standards are based. Examples include historical cost, revenue recognition, full disclosure, materiality, and consistency.

Our Team Will Connect You With a Vetted, Trusted Professional

Revenues are to be recognized (reported) on a company’s income statement when they are earned. Therefore, a company will report some revenues on its income statement before a customer pays for the goods or services it has received. In the case of cash sales, revenues will be reported when customers pay for their merchandise. If customers pay in advance, the revenues will be recognized (reported) after the money was received. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Preparation is the key to success when trying to pass your accounting class. The best way to prepare for your next accounting test or quiz is to work on accounting problems you’re likely to see on your test. This free accounting principles practice test assesses your knowledge of some of the most common questions that students encounter on their accounting exams. It will help you quickly identify your strengths and focus your efforts on where you need more study and practice.

Try out these quiz questions and answers and check your financial knowledge. Accounting principles are the common rules and guidelines that companies need to follow while preparing and presenting financial statements. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. These rules or standards allow lenders, investors, and others to make comparisons between companies’ financial statements.

Many businesses are required to have their financial statements audited to assure the users that the amounts are objective and reliable. If a company has two acceptable ways to record and/or report a transaction, conservatism directs the accountant to choose the alternative that results in less net income or a smaller asset amount. The accountant should be objective, but when doubt exists, conservatism should be used to break the tie. It also means that financial statements can be prepared for a group of separate legal corporations that are controlled by one corporation. This group of commonly owned corporations is referred to as the economic entity. The set of financial statements that reports the combined activity of the group is referred to as consolidated financial statements.

Buy UK perfect super clone Rolex Daytona watches online. Swiss Made AAA Fakes Watches UK Shop:www.rolexreplicaswissmade.com/Watches/Daytona.php