Solid State Battery Market Outlook

The global solid-state battery market is gaining significant traction, driven by technological advancements, increasing investments, and the rising demand for efficient energy storage solutions. In 2024, the market size was estimated at approximately USD 796.92 million. With a remarkable compound annual growth rate (CAGR) of 33.3% projected between 2025 and 2033, the market is set to reach an impressive value of around USD 10,612.37 million by 2034.

Market Overview

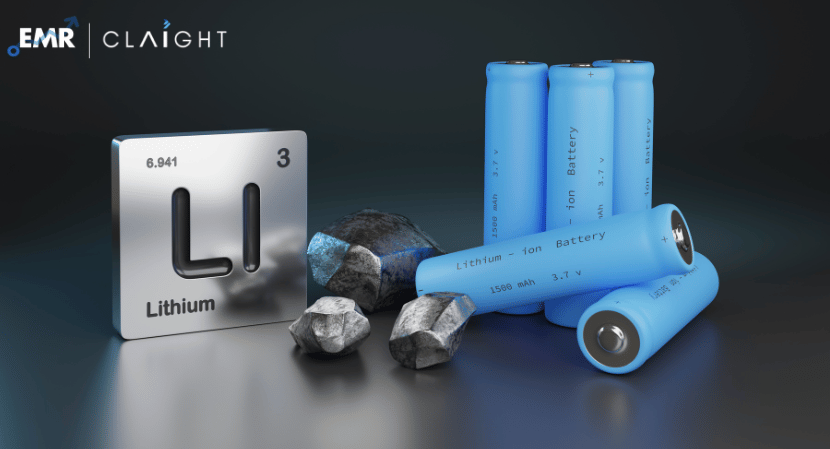

Solid-state batteries represent a groundbreaking innovation in the field of energy storage. Unlike conventional lithium-ion batteries that rely on liquid electrolytes, solid-state batteries use solid electrolytes, offering numerous advantages such as enhanced safety, greater energy density, and longer life cycles. These attributes make them highly suitable for a variety of applications, including electric vehicles (EVs), consumer electronics, and renewable energy systems.

Key Drivers of Market Growth

- Increased Adoption of Electric Vehicles (EVs) The automotive industry’s shift towards electrification is a significant driver of the solid-state battery market. Major automobile manufacturers are investing heavily in solid-state battery technology to enhance the range, safety, and performance of EVs.

- Demand for High-Performance Batteries Industries such as consumer electronics and aerospace demand batteries that offer high energy density and safety. Solid-state batteries fulfill these requirements, making them an attractive choice for next-generation devices and systems.

- Growing Focus on Sustainability Solid-state batteries contribute to reducing carbon emissions, aligning with global sustainability goals. Their longer lifespan and recyclability further enhance their appeal as an eco-friendly energy solution.

- Technological Advancements Continuous research and development (R&D) efforts have led to significant breakthroughs in solid-state battery technology, including the development of advanced solid electrolytes and scalable manufacturing processes.

- Government Incentives and Policies Governments worldwide are introducing policies and incentives to promote the adoption of advanced energy storage solutions. This includes funding R&D projects and providing subsidies for industries adopting solid-state batteries.

Get a Free Sample Report with Table of Contents@ https://www.expertmarketresearch.com/reports/solid-state-battery-market/requestsample

Challenges Facing the Market

Despite the promising outlook, the solid-state battery market faces several challenges:

- High Manufacturing Costs: The production of solid-state batteries involves complex processes and expensive materials, making them costlier than traditional batteries.

- Scalability Issues: Achieving mass production without compromising quality remains a significant hurdle.

- Technical Limitations: Challenges such as dendrite formation and compatibility of solid electrolytes with various materials need to be addressed.

Applications of Solid-State Batteries

- Electric Vehicles (EVs): Solid-state batteries are set to revolutionize the EV market by providing extended driving ranges, faster charging times, and improved safety. Leading automotive companies, including Toyota Motor Corporation, are heavily investing in this technology.

- Consumer Electronics: The compact size and high energy density of solid-state batteries make them ideal for smartphones, laptops, and wearable devices.

- Renewable Energy Storage: Solid-state batteries can store energy generated from renewable sources like solar and wind power, addressing intermittency issues and supporting grid stability.

- Medical Devices: Their reliability and safety make solid-state batteries suitable for critical applications such as pacemakers and other implantable devices.

- Aerospace and Defense: These batteries’ ability to operate under extreme conditions makes them valuable for aerospace and military applications.

Competitive Landscape

The solid-state battery market is characterized by intense competition among established players and emerging startups. Some key companies shaping the market landscape include:

- Toyota Motor Corporation

- STMicroelectronics International N.V.

- Ganfeng LiEnergy Technology Co., Ltd.

- Ilika Plc

- Samsung SDI Co., Ltd

- StoreDot Ltd.

- Solvay S.A.

- Saft Groupe SAS

- Solid Power, Inc.

- Factorial Inc.

- Others

Regional Analysis

- North America: North America holds a significant share of the solid-state battery market, driven by strong R&D initiatives, government support, and the presence of leading companies. The United States, in particular, is witnessing increased adoption in automotive and aerospace sectors.

- Europe: Europe’s focus on sustainable energy and electric mobility positions it as a key region for market growth. Countries like Germany, France, and the UK are at the forefront of adopting solid-state battery technology.

- Asia-Pacific: The Asia-Pacific region is expected to dominate the market, with countries like China, Japan, and South Korea leading in production and adoption. The presence of major manufacturers and rising EV adoption contribute to this growth.

- Rest of the World: Regions such as Latin America and the Middle East are gradually exploring solid-state battery applications, driven by renewable energy projects and industrial growth.

Future Prospects

The solid-state battery market is poised for exponential growth, fueled by ongoing innovations and increasing adoption across diverse industries. Key trends shaping the future include:

- Commercialization of Advanced Batteries: Companies are racing to overcome technical and cost barriers to bring solid-state batteries to the mass market.

- Collaborations and Partnerships: Strategic alliances among manufacturers, research institutions, and end-users are accelerating technological advancements and market penetration.

- Integration with IoT and AI: The rise of smart devices and connected systems is creating new opportunities for solid-state battery applications.

- Focus on Recycling: As sustainability gains prominence, efficient recycling methods for solid-state batteries will become a priority.

Media Contact:

Company Name: Claight Corporation

Contact Person: Eren smith, Corporate Sales Specialist – U.S.A.

Email: sales@expertmarketresearch.com

Toll Free Number: +1-415-325-5166 | +44-702-402-5790

Address: 30 North Gould Street, Sheridan, WY 82801, USA

Website: https://www.expertmarketresearch.com

Aus. Site: https://www.expertmarketresearch.com.au